4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - upward.

Moving average (20; smoothed) - up.

CCI: 17.9996

The third trading day of the week begins with a strong downward movement that began the day before. However, according to the "linear regression channels" trading system, this movement is still characterized as a downward correction within the framework of an upward trend. The moving average line has not been worked out yet, but it can keep the price above itself and keep the upward trend. It is still difficult to say what to expect from the behavior of the EUR/USD currency pair. After such a strong upward movement, we can now expect an equally strong downward movement, at least as part of the correction. After completely ignoring the macroeconomic statistics in the last 10 days, we can expect the same reaction from traders on Wednesday, March 11. And on this day, traders will have something to pay attention to.

First, a press conference of the working group on "coronavirus" will be held in America at night. Clearly, traders will get new information about how the US plans to fight the epidemic and what measures will be taken. Again, it is difficult to say whether this information will be followed by any reaction of traders, but this information is extremely important at the present time.

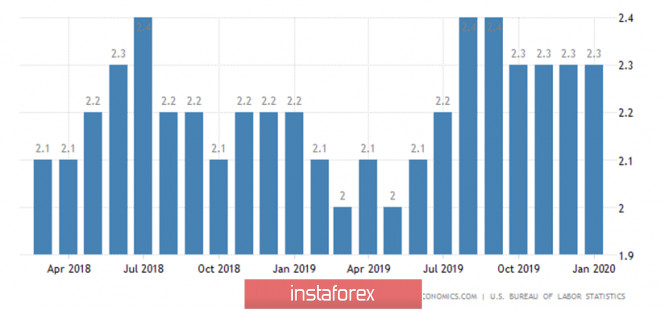

Second, US inflation will be published today. As we have already said, almost all statistics, wherever they come from, are now ignored by market participants. However, we continue to lean towards the option that the Fed was very hasty in lowering the key rate immediately by 0.5%. Moreover, we believe that Donald Trump took a direct part in making this decision, as the most interested person in lowering the key rate as quickly as possible and as low as possible. The official position of the Fed is to prevent the negative impact on the economy due to the "coronavirus". However, in our humble opinion, if the virus cannot be localized and stopped from spreading, then no monetary or financial measures will help any economy in the world. Today we will be able to find out whether there is any negative impact of what is happening in the world on inflation in the States? The so-called core inflation rate is expected to remain unchanged. It has been stable at 2.3% y/y for the past four months. This indicator does not take into account changes in energy prices (which is very important when the price of oil has collapsed) and food. According to forecasts, we can say that they are now quite formal, because if there is an impact of the epidemic, then most likely inflation will slow down.

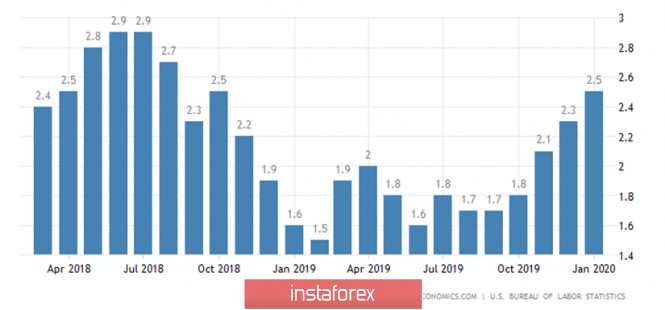

The second indicator of inflation (the main one) has accelerated to 2.5% y/y in recent months, but in February it is expected to slow down to 2.2% y/y. For the US, this decline is not critical, since the indicator will remain above the Fed's target level of "2% or higher". However, perhaps the consumer price index will slow down more? And at the end of March, it may fall again due to the strongly fallen oil prices. On the other hand, the Fed has eased monetary policy, so it is not known what will happen to this indicator.

Also, a topic for discussion now is Trump's "loud" statements that the country can reduce taxes for Americans on wages. Given Trump's love of populism, his sincere belief that everything that has happened to America in the past three years is solely his merit, given his statements on the "coronavirus", which have already been criticized by representatives of the medical sphere, it is already possible to assume that the American President will try to show the public everything in this topic as if he defeated the virus or did everything necessary to overcome the epidemic. In general, we should expect new "high-profile" statements from the US leader in the near future. Official information suggests that there are no special reasons to reduce taxes for US citizens. Trump said he would discuss the issue with Congress and the Senate. However, it is Congress that will initially vote for Trump's proposal. And the President doesn't have a majority in Congress. Moreover, the number of people infected in the United States does not exceed one thousand now. What are a thousand people for a multi-million country? Because of 1,000 people, Trump wants to lower taxes for everyone? It even sounds a little absurd. At the same time, the US leader continues to criticize the Fed, feeling the weakness of the organization at this time. As usual, via Twitter. "Our pathetic, slow-moving Fed, led by Jerome Powell, which raised the rate too quickly and lowered it too late, should lower it to the level of our competing countries. They now have up to two points of advantage and even more help from the currency!" Trump wrote.

From a technical point of view, the correction may end near the moving average. We still believe that more attention should now be paid to technical factors since the macroeconomic background changes too often and too sharply.

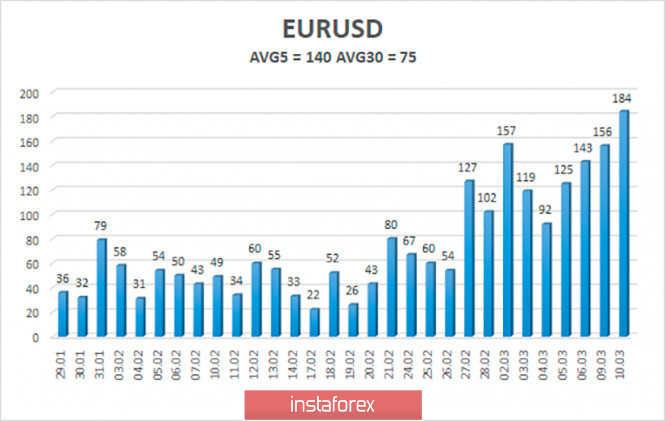

The average volatility of the euro/dollar currency pair remains at record values for the euro currency and has increased to 140 points per day. And these values only confirm once again that the markets continue to be in an excited state and can move unexpectedly and sharply in any direction, which, in fact, showed yesterday. Thus, on Wednesday, we again expect a decrease in volatility and movement within the channel, limited by the levels of 1.1146 and 1.1426.

Nearest support levels:

S1 - 1.1230

S2 - 1.1108

S3 - 1.0986

Nearest resistance levels:

R1 - 1.1353

R2 - 1.1475

R3 - 1.1597

Trading recommendations:

The euro/dollar pair started a downward correction. Thus, now it is still recommended to trade "on trend", that is, to buy the European currency with the targets of 1.1426 and 1.1475 after the Heiken Ashi indicator turns up or after a rebound from the moving average. You can sell the pair after fixing the price below the moving average line with the first target of 1.1146.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com