The global markets are still under the strongest pressure from the impact of the coronavirus on the global economy. This topic remains in the focus of investors around the world.

The announcement by the World Health Organization (WHO) of the coronavirus pandemic on Wednesday led to a new collapse in global markets. Investors do not see anything in front of themselves, except for this topic - neither the publication of economic data, nor news from China that this misfortune is gradually starting to go back there. It can be recalled that the last time the WHO pandemic was announced was 11 years ago due to the spread of swine flu. But then, there was no such hysteria, which is observed in the "Western" media.

We have repeatedly pointed out earlier that the "West" itself agitated these fears and was frightened of it. There are several versions of a conspiracy theological nature, which indicate several reasons for inflating the situation around the Chinese coronavirus. The first is the ongoing sluggish trade war between the United States and China. The American media spread this topic in order to inflict an economic blow on China and force it to make concessions. The second is the desire to cover up the obvious failures of the United States and Western countries from the crisis of 2008-09 and to reset this problem. And the third, in our opinion, the most real one is the irresponsibility of Western democracies and the media, which intensify this problem and then could not deal with it, which resulted in the spread of this misfortune to Europe, and then to the Western hemisphere of our planet.

As we thought, the currency "war" continues in the currency market. Following the United States, Australia and Canada, interest rates on Wednesday were unexpectedly cut by 0.5% by the Bank of England, on the one hand, and as expected by us on the other. This fully confirms our argument that the depreciation of the dollar will stop in relation to major currencies due to lower rates of the Central Bank of the currency, which are among the main ones. We expect the same actions from the RBNZ and today from the ECB.

It can be recalled that today will be a meeting of the European regulator. It is assumed that it will keep interest rates at zero. However, it seems to us that there is a high probability that it can go on to further lower the key interest rate to the level of -0.5%. Otherwise, the single currency may continue to increase against the dollar, pound, which will hit European exports to these countries.

In general, assessing the current situation in the market, we believe that the negative trend will continue. Stock markets will continue to decline, with the most noticeable collapse in emerging markets. But the stock markets of advanced economies will remain under attack. It can be noted that such a landslide drop is positive for stock markets that have grown excessively earlier on various kinds of incentive measures. Thus, economic "bubbles" will continue to burst, but the markets will create excellent conditions for buying risky assets after some time, when the hype around the coronavirus will disappear, and the world Central Banks will actively turn on printing presses and everything will start again.

Forecast of the day:

EUR/USD is trading above the level of 1.1255. An unexpected decision by the ECB to lower interest rates will lead to the resumption of falling prices to the level of 1.1215.

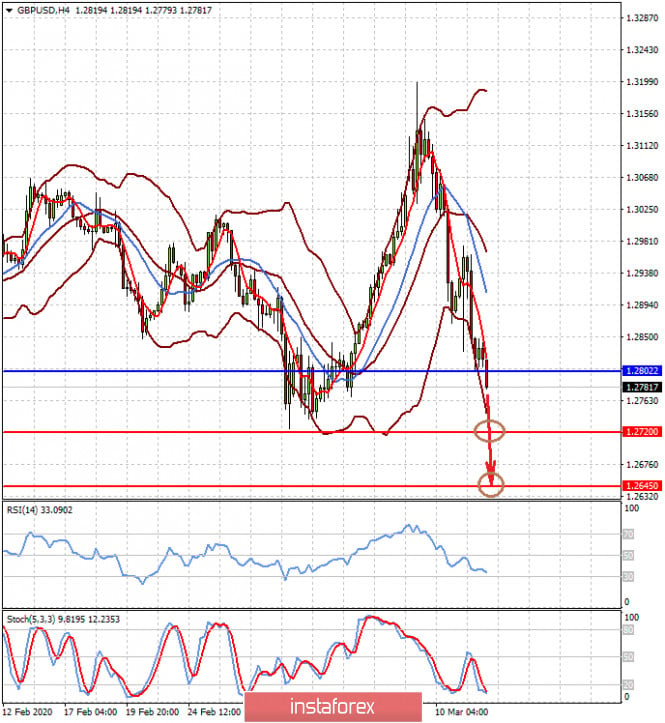

GBP/USD is trading below the level of 1.2800. We believe that it will continue to decline to 1.2720, with the prospect of falling to the level of 1.2645.