The situation around the coronavirus remains the focus of global markets. An official announcement by the World Health Organization (WHO) on Wednesday regarding the pandemic led to a new collapse in the global markets on Thursday.

The panic in the stock markets, as well as commodities on Thursday, was supported by the growth of volatility in the currency market, where, unexpectedly and, one might even say, the US dollar began to be in demand unconventionally for the past 11 years. At the end of Thursday, all major currencies declined against the US currency. What is characteristic is that even traditional safe haven currencies, which have been in demand over the past decade in the wake of the weakness of the dollar due to cuts in interest rates by the Federal Reserve and large-scale stimulus measures, have come under strong pressure, indicating serious turmoil among investors on the market. Historically, the American dollar was in demand precisely in such situations since the twentieth century.

The reason for the collapse before was the decision of US President D. Trump to unilaterally close the opportunity for foreigners to visit America with the exception of Great Britain.

However, against the discouraging issue of the coronavirus, markets have stopped paying attention to incoming economic statistics and even to emergency measures from the world's largest Central Banks. On Thursday, investors first positively received the news from the Fed, which announced that it would conduct three repos as part of an expansion of its program to help support liquidity in the US financial market, but Trump's tweet simply "killed" these optimism germs. In addition, the markets missed the news from the ECB, which announced that it would stimulate the region's economy by $ 120 billion a month until the end of this year, although it did not change interest rates.

In general, evaluating the current mood of investors in the markets, which are combined with the dynamics of the net positions of COT, we can say that the dynamics of the markets will fully depend on the news on the spread of coronavirus in the world. If this misfortune is not stopped in the near future, as it was possible to do in China and Russia, then markets will face a new upsetting event.

Forecast of the day:

EUR/USD is trading below the level of 1.1230. We believe that if the price does not rise above this level, it will continue to decline locally to the level of 1.1000.

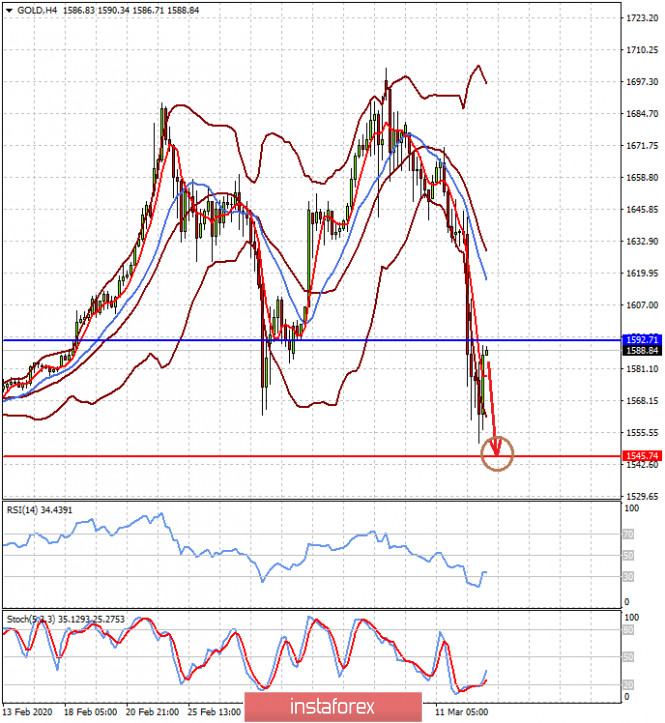

Spot gold is trading below the level of 1592.70. We can expect resumption of its decline if the price does not overcome this level. In this case, the price will resume to decline to the level of 1545.75.