To open long positions on GBP/USD you need:

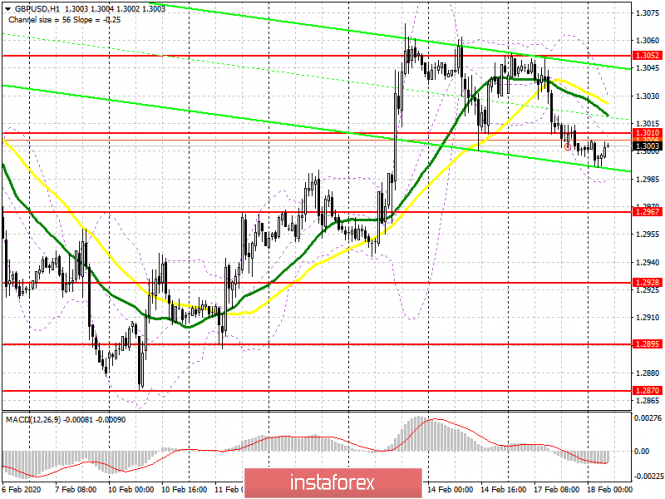

Amid the lack of good news related to negotiations between the UK and the EU on a trade deal, buyers of the British pound are gradually losing optimism. Today there are important reports on the state of the labor market that may support the pound in the short term. Return and consolidation at the level of 1.3010 will be the first signal to open long positions in GBP/USD, which will lead to larger growth in the area of a high of 1.3052, on which the pair's further direction depends. Consolidating above this level, and this can happen only in case of good data on the growth of average earnings in the UK, will open a direct path to the areas of 1.3093 and 1.3133, where I recommend taking profits. In the scenario of maintaining pressure on the pound, it is best to return to long positions only after a false breakout is formed in the support area of 1.2967, but I recommend buying GBP/USD immediately for a rebound after updating a low of 1.2928.

To open short positions on GBP/USD you need:

Sellers took back support at 1.3010 during the Asian session, and the entire calculation is reduced to data on the state of the UK labor market. Poor performance can keep the bearish momentum in the market, and a false breakout forming at 1.3010 will be a direct signal to open short positions, which will lead to a test of lows 1.2967 and 1.2928, where I recommend taking profits. If the unemployment rate drops, then the bulls will regain the area of 1.3010. In this case, it is best to consider new short positions only after updating the high at 1.3052, or sell GBP/USD immediately for a rebound from the 1.3092 area with the aim of a downward correction of 20-30 points.

Signals of indicators:

Moving averages

Trading is carried out below 30 and 50 moving average, which saves the likelihood of the pound declining further.

Bollinger bands

A break of the lower boundary of the indicator in the region of 1.2990 will increase the pressure on the pair. Breakthrough of the upper level in the area of 1.3015 will cause GBP/USD to increase.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20