Panic sales do not subside. The main stock indices of the Asia-Pacific countries lose by 2-4% during the Asian session, the Chinese Shanghai Composite drops by 2.9% as of 5.45 Universal time, while the Japanese Nikkei225 is even at minus 4.6%, which is even more alarming, since the Japanese the economy is extremely dependent on imports of raw materials, and in calmer times, the fall in oil prices leads to an increase in stock indexes, rather than a decrease in them. Apparently, the reason for this is not that we are witnessing an increase in panic, but because a wave of flight has begun not just in defensive assets, but also in the cache, hence the sharp increase in demand for yen and the euro.

Both of these currencies were under pressure amid growing demand for the dollar, as the American economy looked clearly preferable, and capital left Japan and Europe outside the cycle of fluctuations in demand for raw materials and risky assets. Now, this outcome has sharply slowed down after the decline of US stock indices by more than 10%, which has led to an increase in demand for the currency.

Despite the fact that the latest macroeconomic data from the United States still looks convincing, the market does not pay attention to them. Meanwhile, orders for durable goods in January rose more than forecasts, indicating a growing congestion in American industry. The levels of industrial activity are also generally higher than forecasts according to the Fed's regional reports. But at the moment, a completely different criterion is coming to the fore - an increase in the probability of a FOMC rate cut.

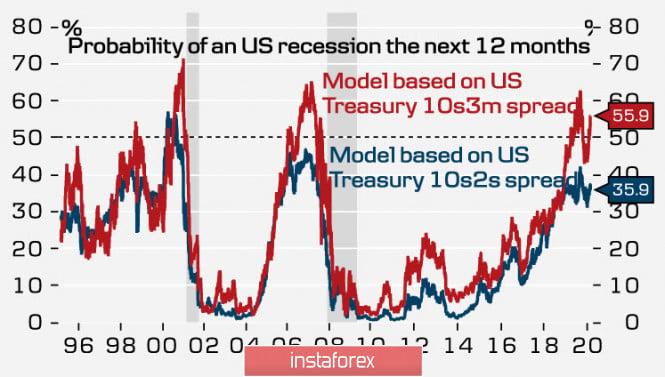

The dynamics of the spread between short-term and long-term bonds, which seemed to have rolled back from dangerous levels in recent months, turned in favor of an imminent recession once again.

As a result, the main driving force for the dollar against the euro and the yen is suddenly changing direction. According to CME, the probability of a one-time reduction in the FOMC rate in the current year increased to more than 80%, and moreover, the probability of a double reduction in the rate exceeded 50% for the first time.

At the same time, both the ECB and the Bank of Japan are not expected to increase the stimulus package. The ECB has taken more risks into account in its decisions than the Fed, and the Bank of Japan has very limited opportunities. All this leads to the fact that the dollar against the backdrop of collapse of stock indices loses investment attractiveness.

The virus in the current conditions looks like a cause of panic sales, but this is hardly true. The real reason is that the leading central banks do not have the tools to achieve demand growth using monetary methods, since most of the methods were exhausted even in the previous wave of the 2008/09 crisis. COVID19 is an ideal cover for a global recession, but it is clearly not the cause of it.

EUR/USD

The possible loss by the dollar of the status of a safe haven currency makes the euro a favorite of the currency exchange market, but in the long term, a reversal has not yet been formalized. A significant reduction in carry trade operations, in which the euro was used as the funding currency, is another source of its recovery.

EUR/USD is currently trying to gain a foothold above the downward trend border of 1.0965 / 85, if successful, there is a high chance of seeing the euro at 1.11 in the very near future.

GBP/USD

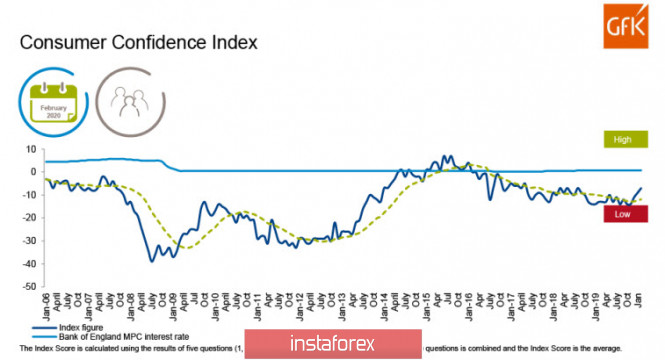

GfK's long-term consumer confidence index has been rising for the third month in a row.

The increase in the index is due to an increasingly positive outlook on the state of the general economy of Great Britain both in the past and in the next 12 months. Consumer demand supports the pound and its decline in the last 3 days is due to the same reasons as the growth of the euro - the withdrawal of players from commodity assets.

A trade dispute with the EU and panic in the markets led to an increase in the probability of a BoE rate drop to 80%, which is another reason for the weakening pound. It can be expected that the slowdown in panic sales will give the pound an impulse for growth. The support zone is 1.2847 / 67, its decline is only possible in case of increased panic. And most likely, the formation of the base and an attempt to return to the growth trajectory.

The material has been provided by InstaForex Company - www.instaforex.com