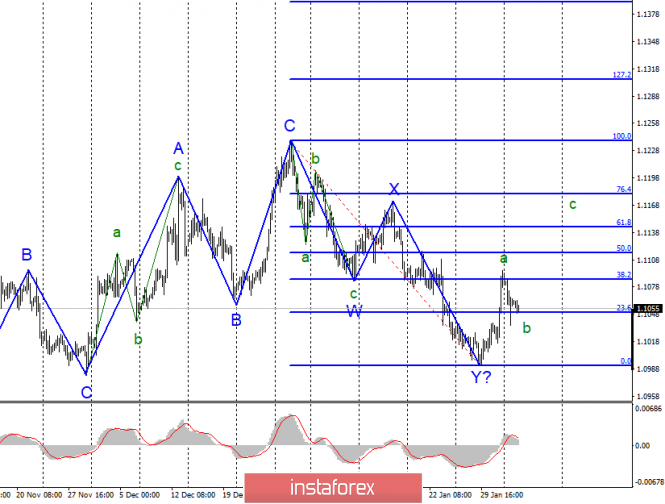

EUR / USD

On February 2, the EUR / USD pair declined by 35 basis points and thus, began the construction of the proposed correctional wave as part of the future upward trend section. If this is indeed the case and the downward trend section is fully integrated, then the quote of the instrument will resume in the near future within the framework of the expected wave C. However, an unsuccessful attempt to break through the 23.6% Fibonacci level may just lead to the completion of the construction of the correctional wave b.

Fundamental component:

Monday's news background was interesting enough again for the euro-dollar instrument. Almost the whole day was focused on the release of data on business activity in the manufacturing sectors of the European Union, individual EU countries, as well as the United States. And I must say that these data did not disappoint the markets since both European and American indices turned out to be better than the markets expected to see. However, due to the fact that the US indices were higher, the US dollar received additional demand, which, by the way, completely coincided with the current wave marking of the instrument. But first things first. The EU business activity index increased to 47.9, adding only 0.1 points. The same index in Germany also increased by 0.1 and amounted to 45.3, in the UK - by 0.2 and amounted to 50.0. Thus, the gains of all key indicators were minimal. Moreover, European and German business activity remained below 50, indicating a continuing slowdown in industries. It is a completely different matter in America, where both business activity indexes have grown. If the Markit index grew by only 0.2 and amounted to 51.9, then the ISM index rose immediately by 3.7 points and amounted to 50.9. Thus, American reports turned out to be corny stronger both in absolute terms and in relative terms. This is precisely what caused the increase in demand for the American currency. During Tuesday, the news background will be weaker. But mainly, there's nothing to pay attention to, only the producer price index in the eurozone, which already came out and amounted to -0.7% in December, which led to a slight decrease in the European currency.

General conclusions and recommendations:

The euro-dollar pair supposedly began to build an upward set of waves. Thus, before a successful attempt to break through the Y- wave minimum, I recommend buying the euro using MACD signals "up" with targets located near the calculated levels of 1.1115 and 1.1144, which equates to 50.0% and 61.8% Fibonacci.

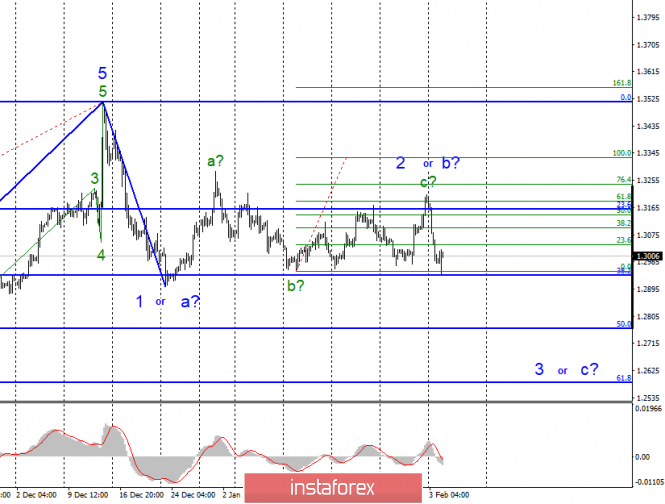

GBP / USD

On February 2, GBP / USD lost about 205 basis points. Thus, the alleged wave 2 or b has acquired a very complex internal wave structure, but can still be considered completed at this time. If this is true, then the pound / dollar instrument has moved on to building a downward wave 3 or c with targets located much lower than 30th figure. However, an unsuccessful attempt to break through the 38.2% Fibonacci level may lead to a departure of quotes again from the lows reached and even more complicate the entire wave structure.

Fundamental component:

The news background for the GBP / USD instrument on Monday was average in strength. Well, at least such a conclusion was suggested based on the contents of the news calendar. The business activity index in the UK manufacturing sector increased by only 0.2 points, but left the area of slowdown, reaching 50.0. This is positive news for the pound. It would have been if it had not been for Prime Minister Boris Johnson, who has made statements before the start of negotiations on a trade agreement with the EU casting doubt on whether this agreement can be reached at all. Johnson said that "the UK intends to get an agreement that will be beneficial to it," he admitted that London could leave negotiations by summer if the European Union does not make concessions. In general, the Prime Minister took a very tough stance on this issue, and the markets responded to Johnson with the bitter sales of the British. On the other hand, the European Union members namely Michel Barnier and Ursula von der Leyen immediately criticized Johnson, saying that he can not sit at the negotiating table at all with such a position.

General conclusions and recommendations:

The pound / dollar instrument supposedly moved to the construction of a downward wave of 3 or C. Thus, now, I recommend selling the British currency with targets located around the level of 1.2764, which equates to 50.0% Fibonacci, and lower. At the moment, I recommend selling the instrument after a successful attempt to break the level of 1.2939, which corresponds to 38.2% Fibonacci.

The material has been provided by InstaForex Company - www.instaforex.com