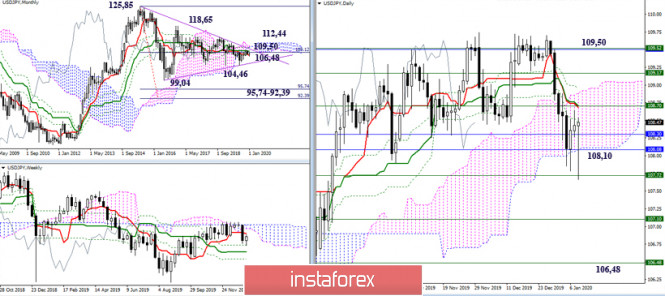

USD / JPY

Last year, the yen spent in the fight against the clouds of Ichimoku the uppermost time intervals (week and month). However, it never managed to reach a significant result during the year, which is why the result of the year resulted in the formation of a candle of uncertainty. In the year 2019, the "Top" with a small range of movement conveyed uncertainty, reflection and struggle in 2020, and the key resistances remained in place. The following lines of 109.50 (weekly cloud + monthly medium-term trend) - 112.44 (monthly cloud) - 118.65 and 125.85 (maximum extremes allowing to leave the zone of uncertainty and struggle, will serve as a guideline for the increase in 2020): restoring an upward trend). For players on the downside, immediate interest is associated with consolidation below the daily cloud (108.11), and thus, breaking this through will open up new possibilities - the fulfillment of the descending goal for the breakdown of the daily cloud and the elimination of the weekly dead cross (107.10 - 106.48). On the other hand, further bearish prospects will be associated with leaving the existing zone of uncertainty (104.46 - 99.04) and moving towards a monthly target for breakdown of the cloud (95.74 - 92.39).

EUR / JPY

For 2019, nothing significant was achieved. In the upper halves, the current advantage remains on the side of the bears, as development continues in the bear zone relative to the weekly and monthly clouds of Ichimoku. Support is currently being provided by the daily cloud (120 - 119.23) and the weekly golden cross (final line 118.43). So, consolidation below these guidelines will allow us to consider a decrease to the minimum extremes of 115.84 - 109.57, with the further possibility of reaching the monthly descending target for the breakdown of the cloud (100.09 - 94.57). For players on the upside, the restoration of positions and prospects lies in 2020 through overcoming the following lines of resistance - 122.55-123.30 (target for breakdown of the daily cloud) - 123.18-125.50 (weekly cloud) - 126.67-129.66 (elimination of the monthly dead cross + breakdown of the monthly cloud).

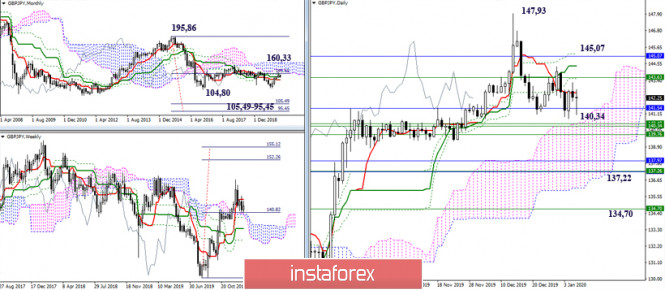

GBP / JPY

The pair finished the year 2019 at about the same positions that it started, only throwing a long lower shadow in the direction of the bears for the year. As a result, it can be noted that the old contradictions persisted and new ones formed. At the moment, the pair has multi-directional targets at higher time intervals. Now, we can say that a certain current advantage belongs to the players on the upside, who maintain their location in the bull zone relative to the clouds (day and week) Ichimoku. The exit from the correction zone and the restoration of the upward trend will be updating of the maximum extremum (147.93), then the interests of the players will be raised to fulfill the raising goal to break the weekly cloud (152.26 - 155.12), as well as to fight the monthly resistance clouds above which are fixed (160.33) will create new global prospects for players to increase. On the other hand, in case of loss of support in the region of 140.34 (weekly cloud + upper border of the daily cloud) and a subsequent decrease to 137.22 (monthly short-term trend) and 134.70 (the final boundary of the weekly golden cross), bearish sentiment will be significantly strengthened, whose task after this will be the restoration of the monthly downward trend (124.80) and the execution of the monthly downward trend on the breakdown of the cloud (105.49 - 95.45).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

The material has been provided by InstaForex Company - www.instaforex.com