4-hour timeframe

Amplitude of the last 5 days (high-low): 59p - 55p - 49p - 64p - 67p.

Average volatility over the past 5 days: 59p (average).

The EUR/USD pair ends the penultimate trading day of the week not only with a downward trend, but also with a weakening downward movement. In general, we can say that an upward correction, which, in principle, would have been logical today, did not happen, but traders did not find sufficient reasons for new sales of the European currency. Thus, the euro fell by several points during the day, having spent the entire trading day near the support level of 1.1109. Slowly, the euro/dollar is approaching its local lows near the level of 1.1069, with which certain problems may arise. Nevertheless, as we have repeatedly noted, the general fundamental background remains on the side of the US currency, so we believe that the downward trend will continue to form, but, as before, we recommend that technical indicators be taken into account as well.

The entire macroeconomic background of the day consisted of data on changes in industrial production in Germany, as well as the level of unemployment in the European Union. Both reports cannot be called excessively important, therefore, it is not surprising that none of them caused strong movements in the forex market. Although statistics from Germany today was unexpected, pleased traders, but at the same time again did not change the overall picture of things in Germany and the European Union. The report on industrial production was stronger than expected by traders and experts. In monthly terms, the growth amounted to 1.1% with the forecast of + 0.7%, and in annual terms - losses of 2.6% instead of the projected 3.8%. What do these numbers mean? That the situation in the industrial sector may begin to improve in the near future. However, we believe that it is too early to draw such conclusions. First, the German industry is still experiencing a decline in annual terms. Secondly, business activity indices in the manufacturing sector of Germany and the EU remain "below the plinth". Thus, we believe that the current high value of industrial production in Germany is somewhat an accident. Perhaps that is why this report did not provide any support for the euro. Furthermore, the unemployment rate in the European Union remained the same at 7.5%, so there is simply nothing to talk about here. There has not been a single important macroeconomic publication in the United States today.

Meanwhile, official information arrived that the Chinese delegation, headed by Vice Premier of the State Council of the PRC Liu He, will visit the White House on January 13-15 in order to sign a "first phase" trade deal with Donald Trump. The parties agreed on the conditions of the first stage of the general agreement on December 13, now it is time to sign.

However, the topic of the trade conflict between China and the United States has now clearly receded into the background. Moreover, we believe that President Trump is doing his best at this time to smooth out any conflicts in which the United States are involved. As we said last year, Trump needs stability before the election. Trump needs victory before the election. He needs economic growth before the election. If there seems to be no problems with the last paragraph, then for the first two there are obviously questions. The conflict with Iran, which began neatly on New Year's Eve, ended as if the parties simply spoke impartially to each other and calmed down. The millionth funeral of General Soleimani, the fierce promises of the Iranian government to avenge, the attacks on military bases in Iraq - and not a single dead American "contractor" ... Iranian military units fired idle? President Trump made a statement, allegedly early warning systems warned in advance American soldiers who managed to take cover. However, the whole conflict looks from the outside as if Iran did not want to answer the United States, realizing that if there are real losses among American soldiers, then the blow Trump spoke about (on 52 objects of Iranian culture) can really be dealt. On the one hand, it's good that we can declare de-escalation of the conflict, on the other hand, it all looks very strange. World analysts have also noted a certain oddity of Trump's retaliatory move, which only announced the introduction of new sanctions against Iran. The kind of sanctions is unknown. It seems that Trump does not need this war before the presidential election, and Iran does not need this war, since the enemy is very strong. Trump is not on the principle now in trade negotiations with China, although we still do not know all aspects of the trade deal that will be signed on January 13-15. The criticism of Jerome Powell, who previously fell under the "shelling" of the White House every week, ended. The topic stalled with the impeachment of Trump, who, most likely, will not be able to overcome the Senate. In general, we believe that in the last year of his presidency, Trump will seek to show the result and will no longer tense the situation on all fronts, as he did in recent years.

Trading recommendations:

EUR/USD generally continues to move down. Thus, now it is recommended for traders to trade lower with the target at the support level of 1.1060 and reduce shorts if the MACD indicator turns up. It will be possible to consider purchases of the euro/dollar pair no earlier than the reverse consolidation of the price above the critical Kijun-sen line with the first target of 1.1224.

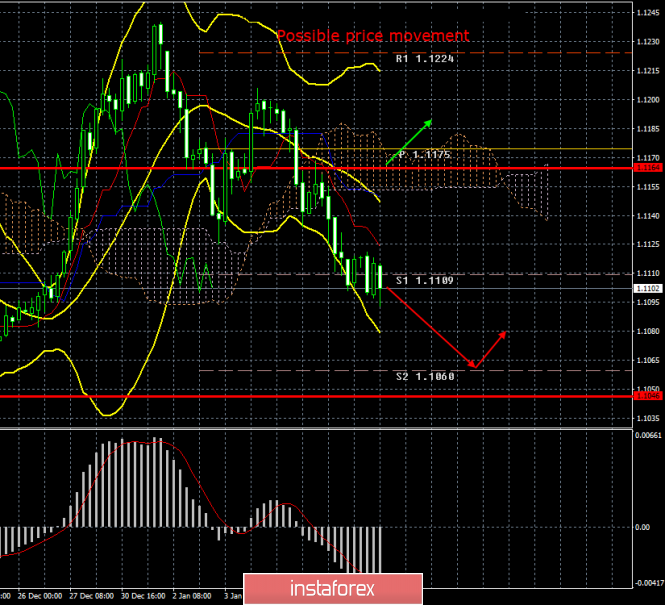

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com