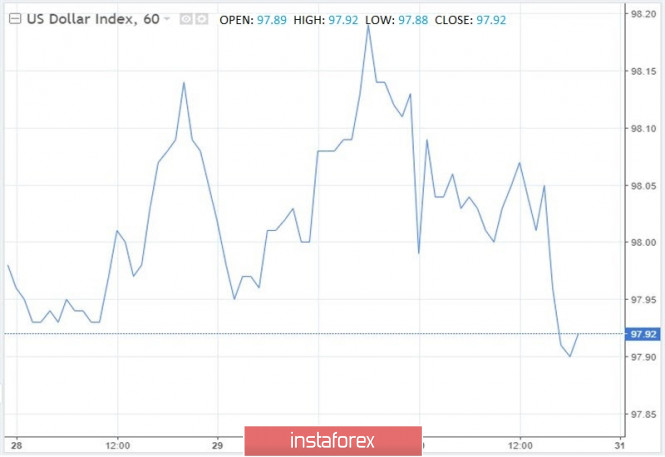

Reaction to the results of the January FOMC meeting were a decrease in the yield of treasury bonds and US stock indices, mixed dynamics of greenbacks and an increased likelihood of a weakening of the Fed's monetary policy in the third quarter of 2020.

Unlike in December, in the January FOMC final statement, US household spending growth was marked as "moderate" rather than "strong". Bloomberg experts predict a slowdown in the growth of personal consumption spending in the US (from 4.6% and from 3.2% in the second and third quarters to 2% in the fourth). Obviously, the US economy is losing momentum. If in October – December net exports and investments in the housing sector contributed to the increase in national GDP, then in January – March, including due to the problems of the Boeing airline giant, the indicator may seriously slow down.

According to Fed Chairman Jerome Powell, the regulator is not satisfied with how inflation works. Amid record long-term economic expansion in the United States and the lowest unemployment rate in the country for half a century, consumer prices should confidently go up. However, over the 12 months, including November, the United States personal spending index rose by only 1.5%. The US central bank sees how in other countries weakening inflation expectations slows inflation, and intends to do everything possible so that nothing like this happens in the United States. In particular, the Fed is willing to tolerate PCE above a 2% target. This means that the barriers to raising the federal funds rate are quite high, while the chances of its reduction remain. This is not good news for the greenback.

Although Powell argues that it is too early to talk about the consequences of the coronavirus epidemic on the global economy, the fact that the Fed is monitoring events in China means that the central bank is closely monitoring the situation. Against this background, rumors appeared that the new virus would become the main reason for the further reduction in the federal funds rate. If during the outbreak of SARS in 2003, China's share in the world GDP accounted for only 4%, but now it is 17%. The number of people infected with coronavirus is about the same as 17 years ago, and the peak of the epidemic has not yet passed.

Thus, an outbreak of coronavirus increases the chances of easing the monetary rate of the Fed. However, it is not a fact that this will necessarily lead to a weakening of the US dollar, since other central banks will also be forced to react if the global economy really has problems.

In the foreseeable future, the US presidential race may also affect the dynamics of the dollar.

According to Wells Fargo experts, strengthening the position of Donald Trump during the election campaign will have a neutral or positive effect on the USD rate.

"Investors seem to like the fiscal stimulus, low tax, and unobtrusive policies of the 45th US president. If Joe Biden begins to gain points, then it will become a neutral factor for the US currency, as the former vice president is unlikely to change anything radically. Strengthening the position of senators (Elizabeth Warren or Bernie Sanders) is likely to be a moderately negative event for the dollar, as both representatives of the Democratic Party are in favor of raising taxes and increasing government spending. The victory of any of them in the elections will mean a radical change in politics," they said.

According to experts, any changes in the preferences of the US electorate will have only a temporary effect on the dollar.

"Historically, the dollar has tended to rise in the year of the presidential election, at least against major currencies. From the beginning of the year until the election (if this is the first term of the incumbent president), the dollar rose by an average of 2.3%. Therefore, in the coming months, the US currency may be stronger than we expect," Wells Fargo representatives said.

"Expectations that Democrats will retain a majority in the lower house of Congress and Republicans in the upper house will reduce the amplitude and duration of fluctuations in the dollar if a clear leader is identified in the presidential race," they added.

The material has been provided by InstaForex Company - www.instaforex.com