Overview:

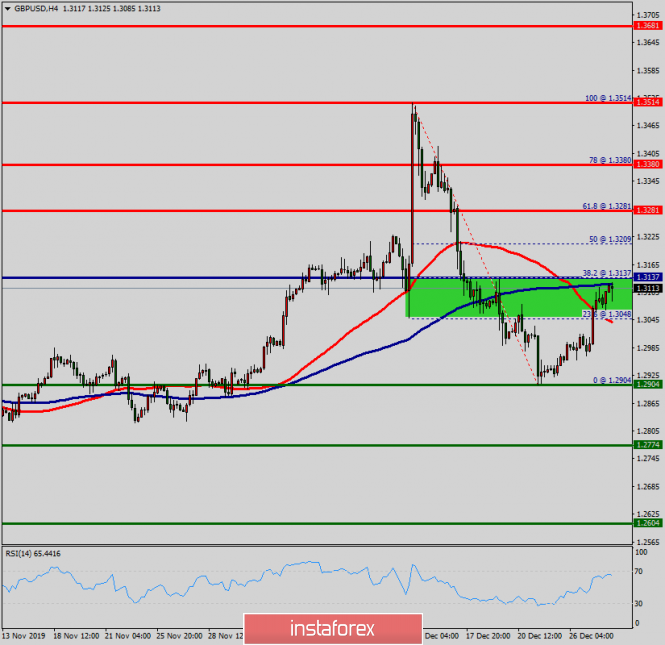

The GBP/USD pair set above strong support at the level of 1.2904, which coincides with the double bottom in the H4 time frame. This support has been rejected for four times confirming uptrend veracity.

Due to the upcoming New Year's holidays of 2020, the trading working hours of many major financial centers was changed, which affected the trading of the GBP/USD pair notably, because the market was not stable and the trend was not clear.

Hence, major support is seen at the level of 1.2904 because the trend is still showing strength above it.

Accordingly, the pair is still in the uptrend from the area of 1.2904 and 1.3070. The GBP/USD pair is moving in a bullish trend from the last support line of 1.2904 towards the first resistance level at 1.3137 in order to test it. The point of 1.3137 is coincided with the weekly pivot point at the same chart.

This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 1.3137 and further to the level of 1.3281 in cmoing hours.

The level of 1.3281 acted as second resistance and the double top had already set at the point of 1.3514. At the same time, if a breakout happens at the support level of 1.2904, then this scenario may be invalidated. But in overall, we still prefer the bullish scenario.

The material has been provided by InstaForex Company - www.instaforex.com