The current trading week looks less saturated for the euro-dollar pair than the previous one. The pre-Christmas bliss is gradually coming into its own, and it will be felt more strongly in the coming days of December. However, the upcoming week is entirely working, so traders will still have time to take advantage of the volatility before the holiday period of suspended animation in the foreign exchange market.

As you know, China and the United States were able to conclude a temporary truce, last week, preventing the escalation of the trade war. Beijing has pledged to increase purchases of US goods (primarily agricultural products) in the next two years by $ 200 billion, while Washington has pledged not to impose "December duties" on Chinese imports of $ 160 billion a year. In addition, the States promised to halve 15 percent duties on 120 billion Chinese goods. At the same time, 25 percent duties on $ 250 billion of imports remain in force.

Now the parties are embarking on the second phase of negotiations, where the most complex and fundamental issues of a strategic nature will be discussed. And while many experts doubt that negotiators will be able to find a common denominator in the long term, the risk of an intensifying trade war has decreased significantly at the moment. Therefore, for EUR / USD traders, the macroeconomic reports that both European and American will again be at the forefront.

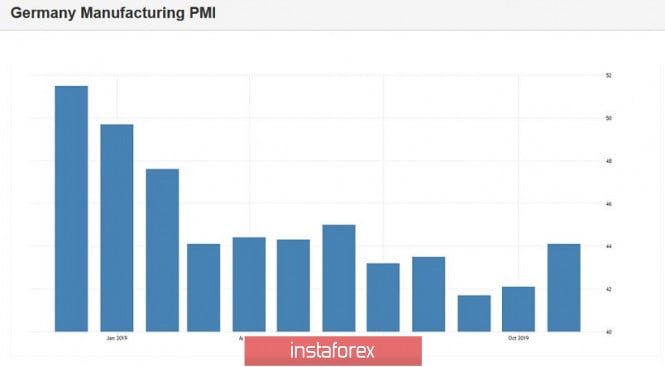

Today, the focus will be on PMI indices in the manufacturing sector and in the services sector where the corresponding releases will be published in Germany, France, and other European countries. Let me remind you that the recently published indices of sentiment in the business environment from the ZEW Institute in Germany and throughout the Eurozone provided significant support to the European currency. The German indicator in December showed the strongest growth in the last two years. The index was above zero for the first time since April and reached 10.7 points, which is so far the best result since February 2018. If today's PMI releases follow the ZEW trajectory, the Euro will receive additional support for its corrective growth. In general, experts anticipate positive dynamics, especially in the service sector. As for the manufacturing sector, the minimum growth is predicted in the chart below where the indices will still remain below the key 50-point level. But the very fact of a positive trend can strengthen the position of the single currency.

On Tuesday, December 17, the strongest impact on the EUR / USD pair will be the production indicator in the US processing industry. Again to remind you, that the last production ISM was much worse than the forecast, reflecting the ongoing decline in activity, particularly in the manufacturing sector. The Fed also drew attention to this fact at its December meeting. Therefore, dollar bulls will react extremely sharply to the negative dynamics of this indicator. For two months (September and October), the indicator was in negative territory, but this time analysts are optimistic and according to general expectations, in November it will recover to 0.8%. If the indicator remains in the negative zone, the dollar may fall under a wave of sales. Also on Tuesday, Fed officials John Williams and Eric Rosengren will speak where the market can only react to Williams' comments, as Rosengren will lose the right to vote in the Committee next year.

On Wednesday, we will find out the final estimate of inflation growth in the Eurozone. I would like to note that despite negative forecasts, the consumer price index rose in November, reaching a one percent mark from the previous value of 0.8% (the growth forecast was at the level of 0.7%). Core inflation also showed a positive trend, rising from 1.1% immediately to 1.3%. This is the best result in the last six months. According to the consensus forecast, the final estimate will coincide with the initial data. If the indicators are revised upward by at least one-tenth of a percent, the European currency will again attract buyers. The ECB chief Christine Lagarde will also speak on Wednesday, but her speech will be ceremonial where she is expected to give a welcome speech at the colloquium in honor of Benoit Coeure, so she is unlikely to touch on "serious" topics.

Thursday is full of events for other currency pairs (primarily with the participation of the pound, yen and Australian dollar), while the interest of the euro-dollar pair trailers may attract only the Fed-Philadelphia manufacturing index.

However, on Friday, the EUR / USD will react to the main index of spending on personal consumption, which measures the core level of spending and indirectly affects the dynamics of inflation in the United States. It is believed that this indicator is carefully monitored by members of the regulator. According to forecasts, the index will demonstrate contradictory dynamics where it will grow by 0.2% monthly and it will decrease to 1.5% annually. This release may have an impact on the dynamics of the pair only in case of strong fluctuations when the real figures differ significantly from the forecast values. Also, on the last trading day of the week, the US GDP figure for the third quarter of this year will be published. We will know the final estimate, which is projected to coincide with the original.

The material has been provided by InstaForex Company - www.instaforex.com