A strong report on the US labor market in November provoked a rise in the dollar, but the effect was limited due to a number of additional factors in which the market figured out quite quickly.

A total of 266 thousand new jobs were created in November, and the data for September and October were also revised upwards by 41 thousand. A significant contribution to the final result was the inclusion in the statistics of the return of General Motors jobs after the strike, but without them, it would still remain at a high level.

As a result, the probability of a rate cut at the December meeting of the FOMC is now virtually excluded. The Fed receives a reason for a pause, and expectations on the rate are postponed to March. At the same time, there are several factors that indicate that the labor market is actually slowing down.

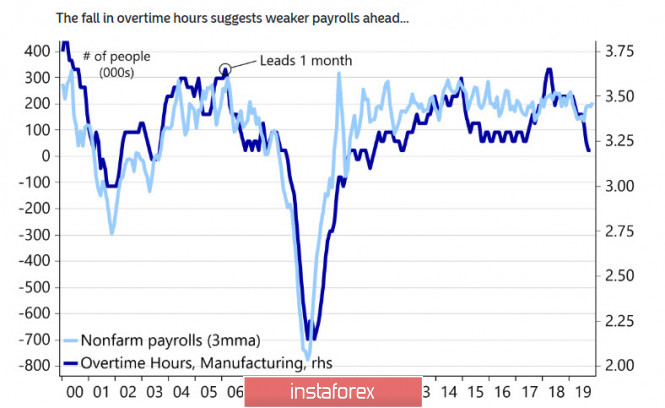

One of these leading indicators is the number of overtime hours worked. Its decrease usually leads to a general cooling of the labor market, and in November, the decline was especially strong.

Meanwhile, the dynamics of NFIB vacancies have a similar dynamics, which showed the worst result in September-October since 2010. The NFIB index for November will be released on Tuesday, and if it turns out to be worse than expected, this will be a sign that a surge in non-pharms may be the last in the future in the coming months.

On the other hand, there is a weak wage growth (below expectations) and, as a result, insufficient inflationary pressure will continue to exert pressure on the dollar.

The development of the situation is pretty much dependent on the outcome of the trade dispute between the United States and China. If pressure on China persists, no deal will be concluded, stock indices will collapse, and the industrial sector will increase the fall, which will lead not only to lower real incomes and lower inflation, but also to a return of the threat of recession. On the contrary, the US economy will receive a positive impulse, if the parties announce successful dynamics in the negotiations or at least freeze current tariffs for the long-term.

EUR/USD

The key event for the euro this week is the ECB meeting on January 12 and the first press conference by Christine Lagarde on its results. No surprises are expected. The markets proceed from the fact that a number of measures announced at the September meeting will continue to operate, and there is no need to correct them. At the same time, even the absence of the need for adjustment will not allow Lagarde to evade a review of the situation, and thus, volatility can increase in any case, even if the wording of the accompanying statement remains unchanged.

Today, it is possible to increase volatility after the publication of Germany's trade balance for October. In turn, ZEW will be released on Tuesday on economic sentiment in the eurozone in December. A slight improvement is expected, which will support the euro before the ECB meeting.

The euro still looks neutral, the decline on Friday was moderate after strong non-farms. Thus, an attempt to resume growth looks a little more likely. The first resistance is 1.11, the next is 1.1172 / 75, and further 1.1208.

GBP/USD

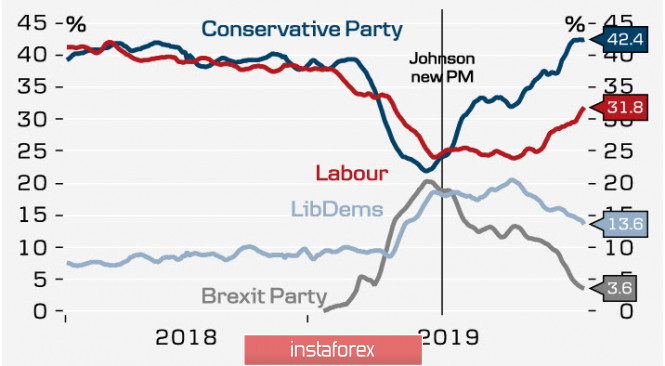

The pound will continue to trade near the 7-month maximum, and even a strong report on non-pharma was almost completely won back by Friday evening. The reason, as usual, is political. According to YouGov's model, which most market participants trust, conservatives are 10-11 votes ahead of all other opponents. If Boris Johnson gets a majority in parliament, he will be able to complete a Brexit deal before Christmas, and Britain will exit the EU on January 31.

If the forecasts do not come true and the opposition receives a majority, then the probability of a second referendum will sharply increase. Thus far, the markets assume that the victory of the conservatives will become a catalyst for a stronger pound, and win back these expectations, and so the pound will remain near the maximum until the election.

On Tuesday, an impressive package of macroeconomic data will be published – the trade balance and industrial production for October, as well as the NIESR estimate of GDP growth. Now, the targets for GBP/USD remain the same - the first resistance is 1.3170/90, while the second is the annual maximum of 1.3380. A correction before the announcement of the first election results is unlikely.

The material has been provided by InstaForex Company - www.instaforex.com