According to experts at Bloomberg, which the popular publication found out in November, the British pound will rise to $1.35 if the Conservative Party wins the election on December 12 and will collapse to $1.27 if Labour takes the majority in the new Parliament. Is it any wonder that GBP/USD soared to its highest level in seven months, the absence of sterling's reaction to the disappointing news from the labor market, inflation and the dovish rhetoric of the Bank of England, if the difference between the Tories and supporters of Jeremy Corbyn increased as X date is approaching? A few days before the election, according to opinion polls, it increased to more than ten percentage points. As a result, turning a blind eye to the bad news, the pound strengthened by 9% from the level of the August low and led the race of the best performers of the year among the G10 currencies, almost bypassing the Canadian dollar on the falling flag.

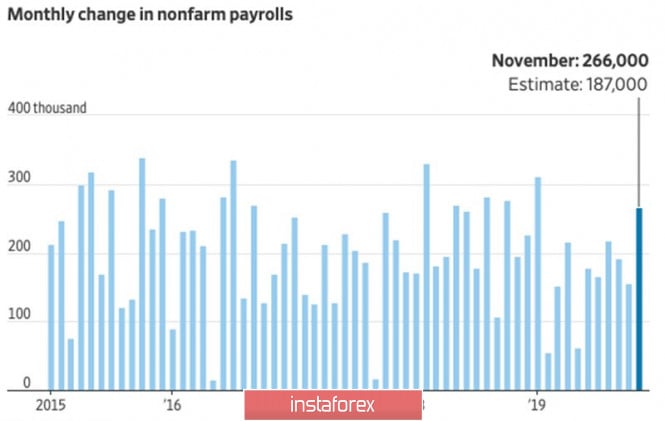

Bulls on GBP/USD were not restrained by strong data on the US labor market in November. Employment outside the US agricultural sector grew by 266 thousand, unemployment fell to 3.5%, and average wages accelerated to 3.1% Y/Y. The S&P 500 index has grown by more than 1%, and its rally has recently served the dollar faithfully. This time the greenback strengthened against most major world currencies, but could not do anything with the pound.

Employment dynamics outside the U.S. agricultural sector

This looks illogical at first glance. A strong report on the US labor market made it possible to raise the forecast for GDP for the fourth quarter to 2%. At the same time, according to Bloomberg experts, in the second half of the year, the British economy teeters on the brink of recession. CME derivatives believe that the Federal Reserve will lower the rate from 1.75% to 1.5% no earlier than September 2020, while the number of supporters of easing monetary policy of the BoE is growing by leaps and bounds. Divergence in economic growth and monetary policy is a strong argument in favor of GBP/USD sales, but the pair is steadily growing. What is the matter?

In my opinion, there was too much negativity in sterling quotes. After ardent Brexiteer Boris Johnson, who promised to take the country out of the EU or die, was given the post of prime minister, investors began to prepare for a no-deal divorce. It only became clear that they were mistaken during the second half of autumn. Sterling rose as a result of the collapse of speculative shorts.

We could face the opposite situation in December. It is likely that the principle of "buy by rumors, sell by facts" will be played out, which increases the risks of, if not a serious correction, then the consolidation of GBP/USD. At the same time, the median forecast of more than 60 Reuters experts suggests that after 12 months the pound will nevertheless reach 1.35, so that any pullback will make it possible to form or build up long positions.

Technically, the quotation of the analyzed pair beyond the short-term consolidation range of 1.277-1.289 contributed to the rise to 7-month highs. 88.6% and 200% of the Bat and AB = CD patterns are within easy reach. Important pivot levels are within the immediate vicinity, which increases the risk of a rebound.

The material has been provided by InstaForex Company - www.instaforex.com