At the opening of the week, Asian stocks traded in different directions. The Shanghai Composite declines amid weaker than expected Chinese foreign trade data. At the same time, the Japanese Nikkei is also falling, while the Australian S & P / ASX 200 is growing at half a percent, reflecting the still growing demand for risky assets.

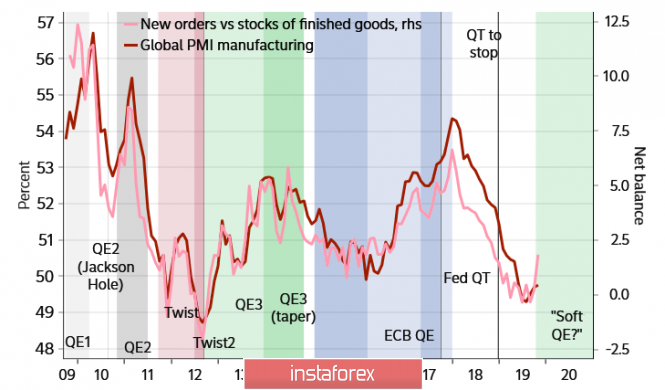

Therefore, the market, apparently, believes that the situation in world trade is gradually improving and the threat of a global recession is decreasing. In favor of this assessment, there has been some positive dynamics in the US and Chinese trade negotiations, as well as the Fed's procurement program, which the markets regard as GE4. On the other hand, purchases in the amount of $ 60 billion per month are expected to be made until April or even until June 2020, which will lead to an increase in liquidity by $ 390-510 billion. These expectations led to attempts to restore the global PMI after the September failure, which first of all, it is reflected in the rapid growth of new orders in the October reports.

How does this optimistic assessment correspond to reality? The answer to this question may appear already this week. On Thursday, November 14, the Fed will publish a new procurement schedule, and optimism will remain dominant if there is no reduction in the rate of purchase of bills. Otherwise, on Friday, there may be a noticeable decline in stock markets and an increase in demand for protective assets.

As for the trade agreements of the United States and China, the optimism here is largely based on rumors, and not on real expectations. The parties, through leaks in the media, seem to have expressed their willingness to gradually abandon tariff restrictions, but the constant shift in the signing of the "1st phase agreement" is making the players more and more nervous.

The dollar, at the opening of the week, looks stronger both against protective currencies and against commodity ones.

USD/CAD

Canadian macroeconomic indicators which were published last week turned out to be significantly worse than forecasts, which, together with the reaction to the FOMC meeting, contributed to the weakening of the "loonie" to 1.32.

Moreover, the trade balance in September showed a slowdown in trade, both export and import volumes decreased, the Ivei business activity index after the September failure did not find any reason to recover more than 10%, the volume of new housing construction decreased, and the number of employees also decreased by 1.8 thousand in October that expected growth of 15.9 thousand/

As a result, the "loonie" did not take advantage of the general growth of optimism in world markets. The chance of a rate cut by the Bank of Canada at a meeting in December is not high and amounts to about 20%, and thus, the Canadian currency still has the opportunity to recover. Today there is a decline in optimism, oil is losing more than 1%, demand for protective assets is resuming, so attempts to reduce USD/CAD will be limited and will be bought out. In addition, the resistance at 1.3235 represents both the middle of the channel and the 40-day SMA, so to overcome it, it is necessary to accumulate strength, but in any case, the favorite in this pair is just the dollar, not the loonie.

USD/JPY

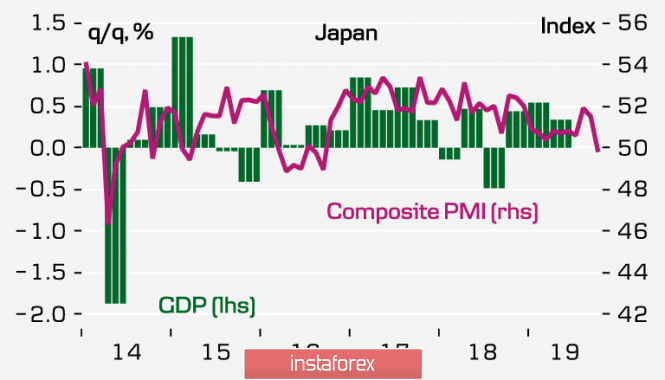

On Wednesday, November 13, GDP data for the 3rd quarter will be published, despite the strong drop in orders in mechanical engineering, the Japanese economy still looks confident, and there is no threat of recession. Export volumes are stable, business activity indices are still holding around 50p. Moreover, the effect of the October increase in VAT is expected.

This morning, the Cabinet of Ministers published the results of the Eco Watchers study. The forecast for the next month turned out to be slightly higher than expected, while the current situation index fell to a minimum since 2011, which does not give reason to expect Japan's economic growth in the short term. Meanwhile, the Nikkey index is unlikely will be able to continue to grow after the US indices.

The attempt to gain a foothold above 109.30 was unsuccessful. The yen rolled lower, but the upward momentum is still strong. Now, if you try to reduce to 108.63, the resumption of purchases is likely to return to the area of maximum 109.44.

The material has been provided by InstaForex Company - www.instaforex.com