Forecast for November 27:

Analytical review of currency pairs on the scale of H1:

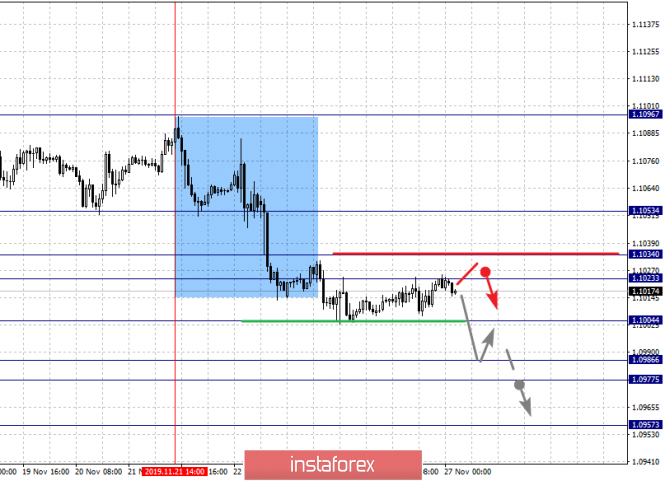

For the euro / dollar pair, the key levels on the H1 scale are: 1.1053, 1.1034, 1.1023, 1.1004, 1.0986, 1.0977 and 1.0957. Here, we continue to monitor the development of the downward structure of November 21. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.1004. In this case, the target is 1.0986. Price consolidation is in the range of 1.0986 - 1.0977. For the potential value for the bottom, we consider the level of 1.0957. Upon reaching this value, we expect a rollback to the top.

Short-term upward movement is expected in the range 1.1023 - 1.1034. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1053. This level is a key support for the downward structure.

The main trend is the downward structure of November 21

Trading recommendations:

Buy: 1.1023 Take profit: 1.1034

Buy: 1.1036 Take profit: 1.1050

Sell: 1.1004 Take profit: 1.0988

Sell: 1.0975 Take profit: 1.0958

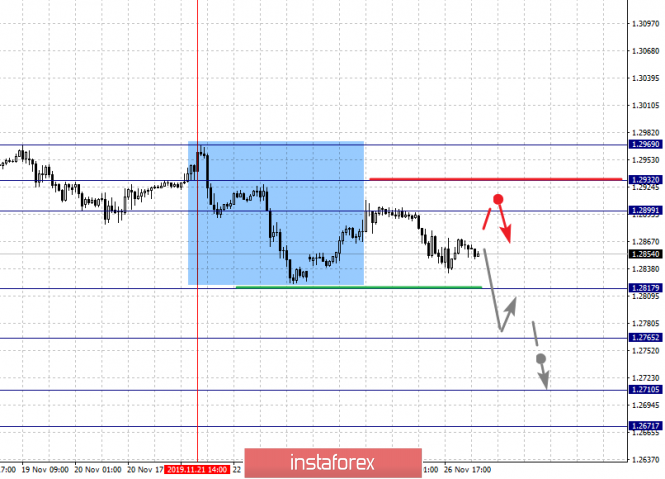

For the pound / dollar pair, the key levels on the H1 scale are: 1.2969, 1.2932, 1.2899, 1.2817, 1.2765, 1.2710 and 1.2671. Here, we are following the formation of the initial conditions for the downward cycle of November 21. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2817. In this case, the target is 1.2765. Price consolidation is near this level. The breakdown of the level of 1.2765 will lead to a pronounced movement. Here, the target is 1.2710. For a potential value for the bottom, we consider the level of 1.2671. Upon reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is possibly in the range of 1.2899 - 1.2932. The breakdown of the latter value will lead to the formation of an upward structure. Here, the potential target is 1.2969.

The main trend is the formation of the downward structure of November 21

Trading recommendations:

Buy: 1.2900 Take profit: 1.2930

Buy: 1.2933 Take profit: 1.2969

Sell: 1.2815 Take profit: 1.2770

Sell: 1.2763 Take profit: 1.2710

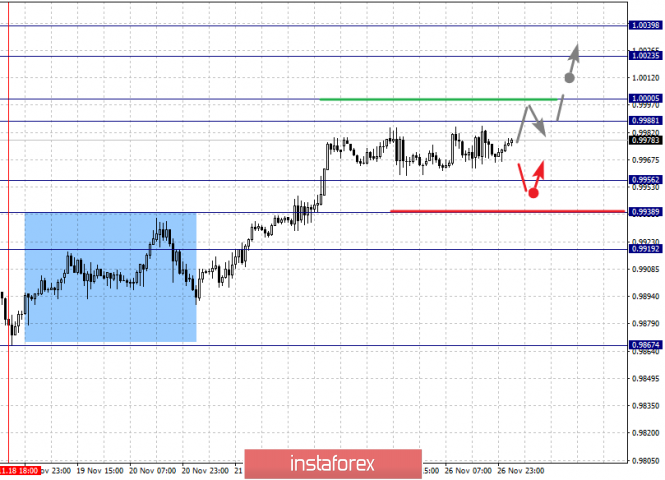

For the dollar / franc pair, the key levels on the H1 scale are: 1.0039, 1.0023, 1.0000, 0.9988, 0.9956, 0.9938 and 0.9919. Here, we are following the development of the ascending structure of November 18. Short-term upward movement is expected in the range 0.9988 - 1.0000. The breakdown of the last value will lead to a pronounced movement. Here, the target is 1.0023. We consider the level of 1.0039 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9956 - 0.9938. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9919.

The main trend is the upward structure of November 18

Trading recommendations:

Buy : 0.9988 Take profit: 1.0000

Buy : 1.0003 Take profit: 1.0023

Sell: 0.9956 Take profit: 0.9940

Sell: 0.9937 Take profit: 0.9920

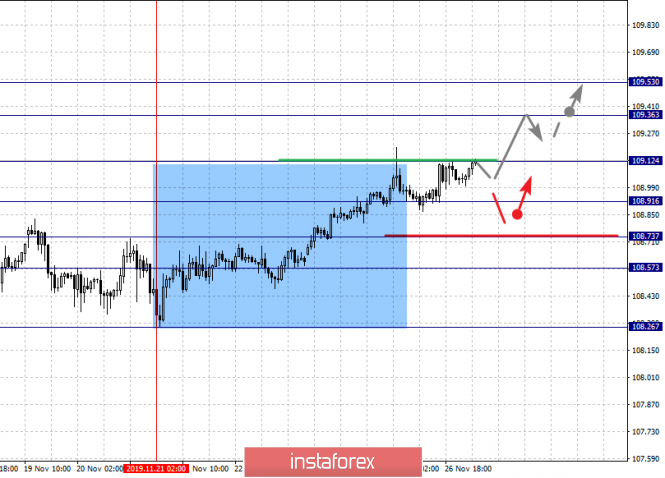

For the dollar / yen pair, the key levels on the scale are : 109.53, 109.36, 109.12, 108.91, 108.73, 108.57 and 108.26. Here, we are following the formation of the ascending structure of November 21. Short-term upward movement, as well as consolidation, are expected in the range of 108.91 - 109.12. The breakdown of the level of 109.12 should be accompanied by a pronounced upward movement. Here, the goal is 109.36. For the potential value for the top, we consider the level of 109.53. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement, as well as consolidation, is expected in the range 108.73 - 108.57. The breakdown of the latter value will favor the formation of a downward structure. Here, the potential target is 108.26.

The main trend: the formation of the ascending structure of November 21

Trading recommendations:

Buy: 109.13 Take profit: 109.34

Buy : 109.37 Take profit: 109.53

Sell: 108.70 Take profit: 108.60

Sell: 108.54 Take profit: 108.30

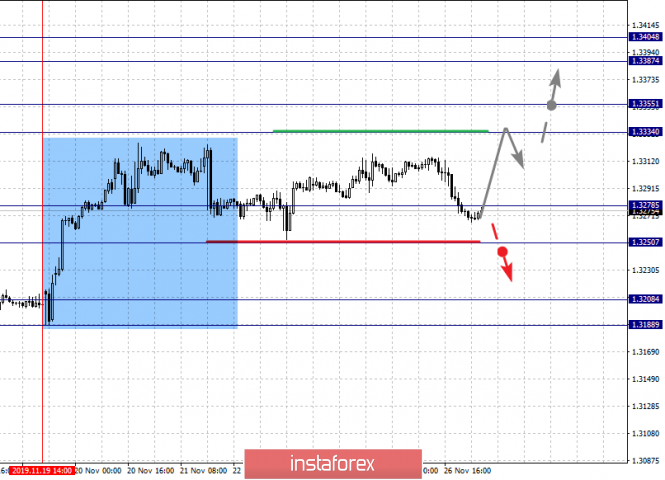

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3404, 1.3387, 1.3355, 1.3334, 1.3298, 1.3278 and 1.3250. Here, we are following the ascending structure of November 19. We expect short-term upward movement in the range of 1.3334 - 1.3355. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3387. Price consolidation is in the range of 1.3387 - 1.3404, and from here, we expect a correction.

Short-term downward movement, as well as consolidation are possible in the range of 1.3298 - 1.3278. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3250. This level is a key support for the upward structure.

The main trend is the upward structure of November 19, the correction stage.

Trading recommendations:

Buy: 1.3335 Take profit: 1.3355

Buy : 1.3357 Take profit: 1.3385

Sell: 1.3276 Take profit: 1.3252

Sell: 1.3248 Take profit: 1.3220

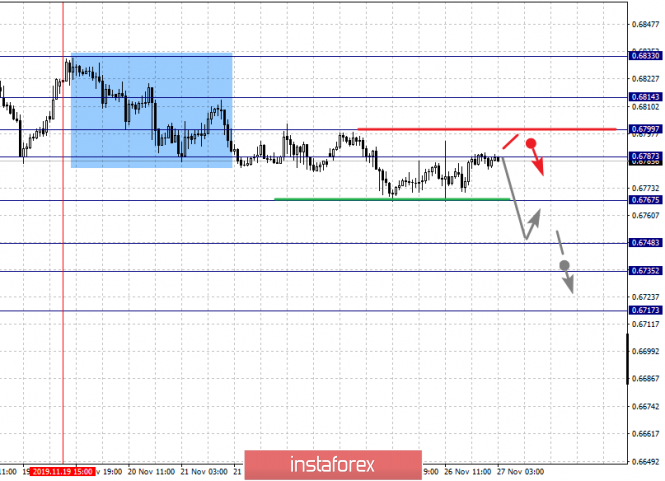

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6833, 0.6814, 0.6799, 0.6787, 0.6767, 0.6748, 0.6735 and 0.6717. Here, we are following the development of the downward structure of November 19. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6765. In this case, we expect a pronounced movement to the level of 0.6748. Price consolidation is in the range of 0.6748 - 0.6735. We consider the level of 0.6717 to be a potential value for the bottom; upon reaching this value, we expect a correction.

Short-term upward movement is expected in the range of 0.6787 - 0.6799. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6814. This level is a key support for the downward trend.

The main trend is a local descending structure of November 19

Trading recommendations:

Buy: 0.6787 Take profit: 0.6797

Buy: 0.6800 Take profit: 0.6814

Sell : 0.6766 Take profit : 0.6750

Sell: 0.6746 Take profit: 0.6736

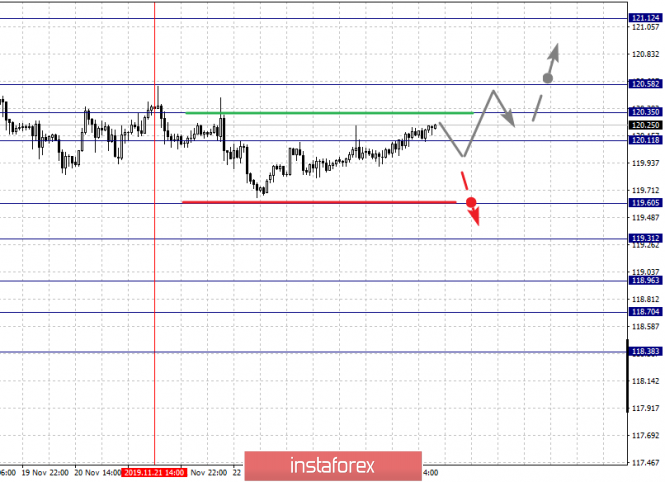

For the euro / yen pair, the key levels on the H1 scale are: 121.12, 120.58, 120.35, 120.11, 119.60, 119.31, 118.96, 118.70 and 118.38. Here, we are following the formation of the downward structure from November 21. At the moment, the price is in the correction zone from this structure. Short-term downward movement is expected in the range 119.60 - 119.31. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 118.96. Short-term downward movement, as well as consolidation is in the range of 118.96 - 118.70. For the potential value for the bottom, we consider the level of 118.38. Upon reaching this value, rollback to the top.

Short-term upward movement is expected in the range of 120.11 - 120.35. The breakdown of the latter value will lead to the formation of a local structure for the top. Here, the first goal is 120.58.

The main trend is the formation of the downward structure of November 21, the correction stage

Trading recommendations:

Buy: 120.11 Take profit: 120.33

Buy: 120.36 Take profit: 120.58

Sell: 119.60 Take profit: 119.34

Sell: 119.28 Take profit: 118.96

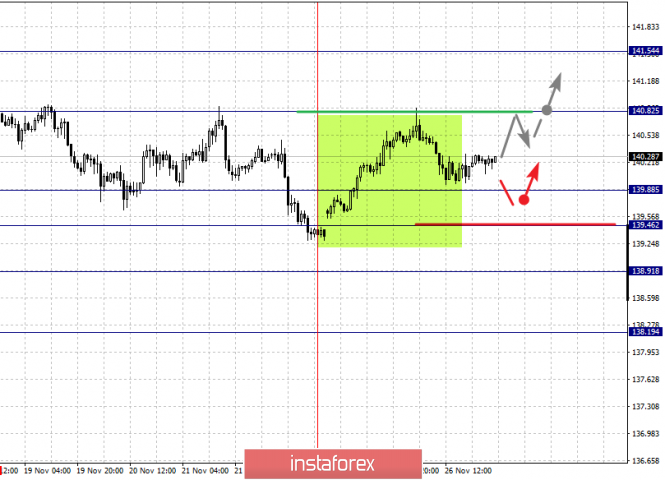

For the pound / yen pair, the key levels on the H1 scale are : 141.54, 140.82, 139.88, 139.46, 138.91 and 138.19. Here, the price forms the medium-term initial conditions for the downward movement of November 18 and at the moment, the price is close to canceling this structure, for which a breakdown of the level of 140.82 is necessary. Here, the potential target is 141.54. Short-term downward movement is possibly in the range of 139.88 - 139.46. The continuation of the development of the downward trend on the H1 scale is expected after the breakdown of the level of 139.46. In this case, the target is 138.91. Price consolidation is near this level. We consider the level 138.19 to be a potential value for the bottom. Upon reaching this level, we expect a pullback to the top.

The main trend is the medium-term downward structure of November 18, the stage of deep correction

Trading recommendations:

Buy: 140.84 Take profit: 141.50

Sell: 139.88 Take profit: 139.48

Sell: 139.44 Take profit: 138.94

The material has been provided by InstaForex Company - www.instaforex.com