The cryptocurrency market has sagged very much since the end of September, the first cryptocurrency has lost an average of 20% relative to the $ 10,000 milestone, eventually focusing within the $ 7,800 mark. After that, the disappointed investors went into the stage of a sluggish fluctuation of 7800/8500, where the quotation is still located. The return of the harsh winter of 2018 to colic scares already frightened traders. The cryptocurrency market is disappointingly declining, IEO, an analogue of the ICO hype, does not bring decent profit and is already disappointingly going into existence. The launch of the Bakkt crypto platform, from which an influx of institutional investors was expected, was launched with ridiculous trading volumes, and regulators are increasingly skeptical about the future of the crypto industry. In the end, we have what we have, but I think this is not the end.

Digest of bygone days:

- Against the cryptocurrency Tether and the Bitfinex exchange filed a lawsuit for $ 1.4 trillion. According to lawyers, in this case there is a violation of the antitrust laws and the law "On commodity exchanges", since Tether controls more than 80% of the stablecoins market in the USA and the world. The exchange is also accused of manipulation, money laundering and the provision of knowingly false information.

- Not the best information for the crypto industry, but similar raids on the Bitfinex structure have already been in history, let's see how things go this time.

- German Finance Minister Olaf Scholz called on EU leaders to create a cryptocurrency analogue of the euro so as not to lag behind the US, China and Russia, as well as private companies that create digital payment assets.

- These calls from the Europeans have already sounded earlier, but to a greater extent the result is zero.

- The World Federation of Exchanges [WFE] turned to the financial regulator of Britain [FCA] with a request not to prohibit cryptocurrency derivatives trading in the country for retail investors. Let me remind you that the World Federation of Exchanges unites 70 operators, such as ICE, Nasdaq, Deutsche Boerse, CME, etc.

- The US Securities and Exchange Commission (SEC) has once again contributed to the current market by stating that they do not consider Bitcoin to be valuable paper, as investors are not dependent on third parties for making a profit.

- Valdis Dombrowski, Vice President of the European Commission [EC] for Financial Services and Economics, has promised that the EC will introduce new rules for regulating the cryptocurrency industry, but with one comment - its re-election to this position.

- As we can see, the information background has a considerable burden of alertness, which fully reflects the current behavior of the first cryptocurrency [BTC].

What do we have on the trading chart?

Monday favored bitcoin, and the quote locally managed to grow as much as $ 444, but this did not change anything in the current situation, we continue to fluctuate within the given frames 7800/8500.

What are the assumptions for further development?

At the moment, nothing dramatic in terms of changing market sentiment is visible. Motion in a given amplitude [7800/8500] can still be maintained throughout the week. The speculative mood is very skeptical, and here we need some kind of clear impetus in terms of information in the form of the hope of traders that the harsh winter of 2018 is postponed. Perhaps a yield higher than 8800-9000 will give optimism to speculators, but I think not earlier than this. Therefore, we sit outside the market and observe what is happening, preferably in USD, and as soon as there is a prerequisite for the move, again in the region of 8800-9000, you can go for an exchange of USD ---> BTC.

Key coordinates for the upward stroke: 8500; 9400; 10000; 10,950; 12330; 13130; 13970.

Key coordinates for the downward course: 7800; 7000; 6500; 6000.

The general background of the cryptocurrency market

Analyzing the general market capitalization, we see a very sluggish development in the range of $ 209 and $ 225 billion. Over a month more than $ 62 billion was lost from the piggy bank of total market capitalization, at the moment we are at around $ 222.19 billion.

If we consider the volume chart in general terms, then the current ceilings are 225 ---> 272 ---> 281 ---> 320 ---> 356 ---> $ 385 billion.

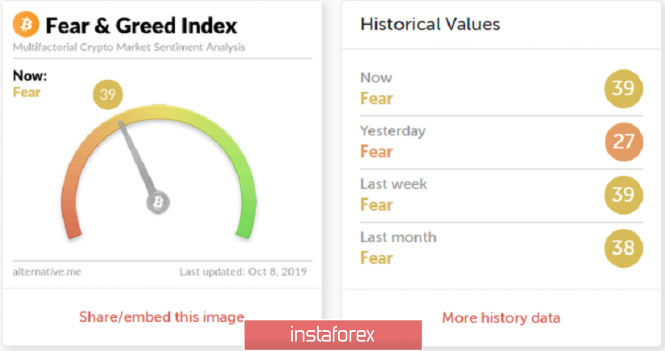

The index of emotions, which is also fear and the euphoria of the crypto market, is surprisingly at 39p, which is almost the same as it was in September before the fall. Nevertheless, optimism among crypto enthusiasts still persists, let's hope for the best.

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that indicators on the short and intraday interval signal about purchases, and the medium-term outlook about sales. It is worthwhile to understand that the price movement is in a given corridor, as I wrote above, and, obviously, depending on the development of a particular border, the indicators on the short-term and intraday interval will change. That is, we have local indicators, consider this in the work.

The material has been provided by InstaForex Company - www.instaforex.com