To open long positions on GBP/USD you need:

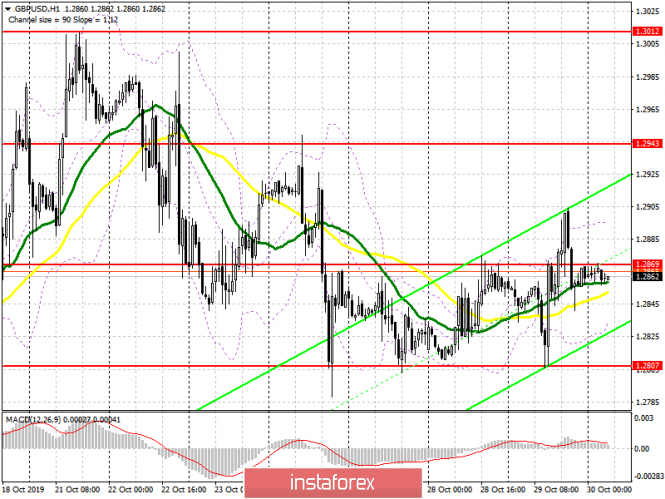

Yesterday's support for the Laborites made it possible to get a majority on the issue of holding general elections in Great Britain, which will be held on December 12 this year. On the one hand, this is good news for the pound, and on the other, further uncertainty may lead to a downward correction of the pair. Yesterday's attempt by the bulls to break above the resistance of 1.2870 was again unsuccessful. Only real consolidation above this level will be a signal to open new long positions capable of updating the highs of 1.2943 and 1.3012, where I recommend profit taking. If pressure on the pound remains in the first half of the day, then only the formation of a false breakout in the support area of 1.2807 will be a signal to buy the pound. Otherwise, it is best to open long positions in GBP/USD by bouncing from a low of 1.2735 or even lower, in the area of 1.2664.

To open short positions on GBP/USD you need:

Yesterday, I noted that the pound is no longer responding to good news, which indicates the absence of major players in the market who want to continue to buy the pound. The next formation of a false breakdout in the resistance area of 1.2870 will be a signal to open short positions in order to break the support of 1.2807, which was formed last Friday. However, a further target will be the level of 1.2735, a breakthrough of which will very quickly pull down GBP/USD to a low of 1.2664, where I recommend profit taking. In the event of a breakthrough of resistance at 1.2870, for example, after the Federal Reserve's decision to leave interest rates unchanged or a weak report on GDP, it is best to consider short positions in GBP/USD from larger highs around 1.2943 and 1.3012.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving average, which indicates the lateral nature of the market.

Bollinger bands

A break of the lower boundary of the indicator at 1.2845 will raise the pressure on the pound. A break of the upper boundary at 1.2880 will lead to a new wave of pound growth.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20