EUR / USD

Friday, October 18, ended for the EUR / USD pair with an increase of 45 basis points and a successful attempt to break through the 50.0% Fibonacci level. Thus, the first wave in the new upward trend section continues to be built despite the fact that there was no important news for the euro-dollar pair during the final period of last week. In addition, the pair has good prospects for a further increase to the level of 61.8%, although from the point of view of wave analysis, the construction of a correctional wave b is expected.

Fundamental component:

The fundamental background for the EUR / USD pair remains weak, ambiguous, and sometimes simply absent. From what side you do not look, but it is definitely not in favor of the euro. At the end of last week and most of the current half, no news and reports from the European Union are expected at all. However, the euro is growing. One gets the impression that the currency market simply wins back the earlier losses of the euro, being ready to resume massive sales of the EU currency at any time. Despite this, all these are reflections and assumptions, nothing more. This week, Thursday, markets will receive a whole package of economic reports and news. Moreover, a meeting of the ECB will be held, at which the rate may be lowered again, although the probability of this is not high. Eurozone and US business activity indices will be released, and changes in the volume of orders for durable goods in the United States. Until Thursday, the news plan will be completely calm.

Purchase goals:

1.1208 - 61.8% Fibonacci

1.1286 - 76.4% Fibonacci

Sales goals:

1.0879 - 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward set of waves. An unsuccessful attempt to break the level of 1.1208 may lead to a departure of quotes from the reached highs and the transition of the instrument to the construction of wave b. On the contrary, a successful attempt will show the intention of the markets to continue to buy the instrument with targets located near the calculated level of 1.1208, which corresponds to 76.4% Fibonacci.

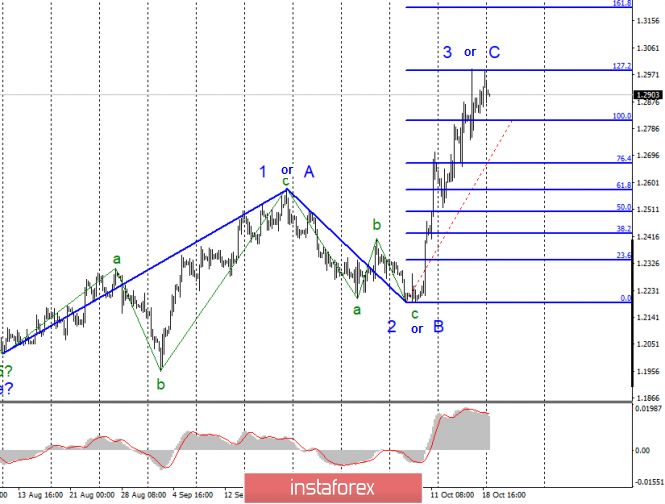

GBP / USD

On October 18, the GBP / USD pair gained 85 more basis points and "pricked" the Fibonacci level of 127.2% once again. The second attempt to break through this level also failed, which suggests the readiness of the instrument once again for the transition to the construction of a downward wave or even a set of waves. The most interesting thing for the pair happened on Saturday, when the Lower House of the British Parliament rejected the government's deal with the European Union again. Thus, Brexit has every chance of being rescheduled for a later date. However, this is negative for the pound, which in recent weeks has risen on expectations of an agreement between the EU and Britain.

Fundamental component:

The news background for the pound-dollar pair continues to consist about Brexit only and everything connected with it. According to recent reports, the British Parliament refused to ratify the agreement reached at the EU summit between Boris Johnson and Donald Tusk, simultaneously obliging the Prime Minister to ask the EU for a new postponement. However, the saga is clearly not yet complete and can turn into a completely different course of events at any moment. Thus, the markets continue to keep a "finger on the pulse" and closely monitor any news from Downing Street 10. It is no secret that Boris Johnson is not going to give up and will continue to try to leave the EU until October 31 in any scenario, which he does not once declared at a time when Parliament had not yet obliged him to strictly follow the plan for concluding a deal with Brussels. In this way, you can expect anything from the Prime Minister. Consequently, Brexit still has a whole range of possible options, each of which can send the pound up or down another few hundred points.

Sales goals:

1.2191 - 0.0% Fibonacci

Purchase goals:

1.2986 - 127.2% Fibonacci

1.3202 - 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument continues to build an upward trend. However, an unsuccessful attempt to break the level of 1.2986 indicates that the instrument is ready to decline. Since the news background is now at its most importance, the continuation or completion of the construction of wave 3 or B will depend on it. The breakdown of the level of 1.2986 can be regarded as a signal to buy.

The material has been provided by InstaForex Company - www.instaforex.com