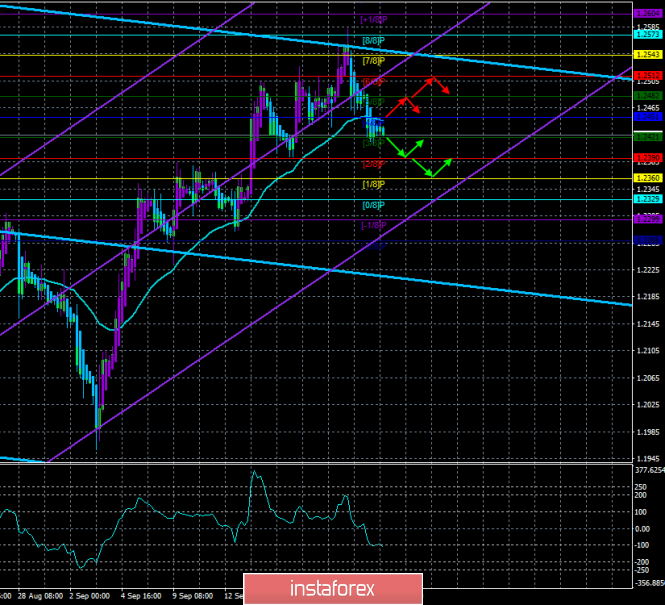

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – down.

The lower channel of linear regression: direction – up.

The moving average (20; smoothed) – sideways.

CCI: -110.0115

Last week, we repeatedly said that the Scottish Court found the actions of Boris Johnson to suspend the work of Parliament illegal, but did not issue any order. The judges of Edinburgh ruled that Boris Johnson had two motives for prorogation: 1) to prevent Parliament from holding the executive branch accountable and passing Brexit laws; 2) to allow the executive branch to hold Brexit without a "deal" without interference from Parliament. Throughout the past week, the UK Supreme Court has been hearing the same case and is finally due to reach a verdict today. Either he admits that Boris Johnson broke the law when he sent parliamentarians on vacation for 5 weeks, or he will rule otherwise. In the first case, Boris Johnson can safely count a new defeat, and the deputies will return to their duties. In the second case, nothing will change, the Parliament will not work until October 14, and the topic with Brexit will hang in the air for several more weeks, because after all the events of the first week of September, when the Parliament nevertheless passed a law banning Johnson from implementing "hard" Brexit, it remains unclear whether the Prime Minister intends to follow this law? The Court's decision is expected at 10:30 am local time.

Meanwhile, according to many publications, Donald Trump and Boris Johnson have agreed to make a big trade deal. It is expected that the agreement will be signed before July 2020, and will come into force no earlier than December 2020, when "the transition period after the implementation of Brexit will end." Interestingly, who said that the transition period will end before December 2020? And who said Brexit itself would be implemented before then? As many experts note, initially Boris Johnson was skeptical about the possibility of concluding a trade deal in 9 months, but afterward, he changed his mind, since the presidential election in the USA is a high risk of a change of president, and it may not be possible to agree with a new US leader. It's hard to tell if a trade deal with the States is good news or not. While no one knows what conditions will be spelled out in this agreement, what are the rights and obligations of the parties? Given Trump's trade claims against China and the European Union, there is a reason to assume that the deal will primarily be in favor of the United States. Will it benefit the UK?

But the trade deal is interesting and the pound is still influenced by the Brexit theme. September ends in a week, and the country must either leave the EU under the "hard" scenario or sign an agreement or postpone Brexit in October. It is still unclear which option will be implemented, but in recent days, traders' optimism about postponing the release date to January 2020 and/or signing a "deal" with Brussels has fallen. Today, no macroeconomic reports are expected from the UK, and the technical picture allows for the continuation of the downward movement, as there are no signs of an upward correction at the moment.

Nearest support levels:

S1 – 1.2421

S2 – 1.2390

S3 – 1.2360

Nearest resistance levels:

R1 – 1.2451

R2 – 1.2482

R3 – 1.2512

Trading recommendations:

The GBP/USD pair moved downwards. Thus, traders are recommended to trade downwards with the targets of 1.2390 and 1.2360, before the reversal of the Heiken Ashi indicator upwards. The decision of the Supreme Court, which will be announced this morning, may affect the mood of traders.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator regression window.

The moving average (20; smoothed) – the blue line on the price chart.

Support and resistance – red horizontal lines.

Heiken Ashi – an indicator that colors bars in blue or purple.

The material has been provided by InstaForex Company - www.instaforex.com