To open long positions on EURUSD, you need:

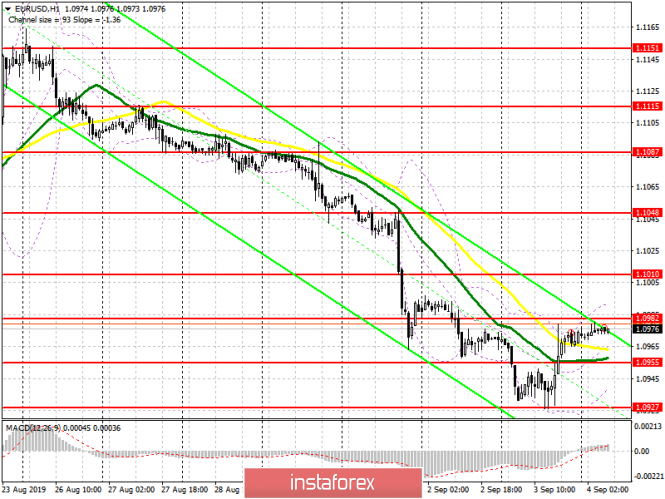

The report on a sharp decline in activity in the US manufacturing sector led to a fall in the dollar and the strengthening of the euro in the afternoon. At the moment, buyers are focused on the breakdown of the resistance of 1.0982, which may occur in the morning after the PMI data for the eurozone services sector. Fixation above the resistance level of 1.0982 will open a direct road to the highs in the area of 1.1010 and 1.1048, where I recommend taking the profits. In the scenario of the euro decline, which may occur after the report on the reduction of retail sales, it is best to consider long positions after the support update of 1.0955, on a false breakdown, or a rebound from a minimum of 1.0927.

To open short positions on EURUSD, you need:

Bears will continue to rely on weak reports on the eurozone, and especially on a reduction in retail sales, which will form a false breakdown of the resistance of 1.0982. This will be the first signal to open short positions that will return EUR/USD to the area of lows of 1.0955 and 1.0927, where I recommend taking the profits. In a scenario of further upward correction and a breakthrough of the resistance of 1.0982, it is best to return to sales only after updating the maximum of 1.1010 or to rebound from a larger level of 1.1048.

Signals of indicators:

Moving Averages

Trading just above 30 and 50 moving averages, indicating a possible continuation of the upward correction of the euro.

Bollinger Bands

The break of the upper limit of the indicator in the area of 1.0985 will lead to further growth of the euro, while the lower limit in the area of 1.0935 will support the pair in case of a decline in the first half of the day.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20