To open long positions on EURUSD you need:

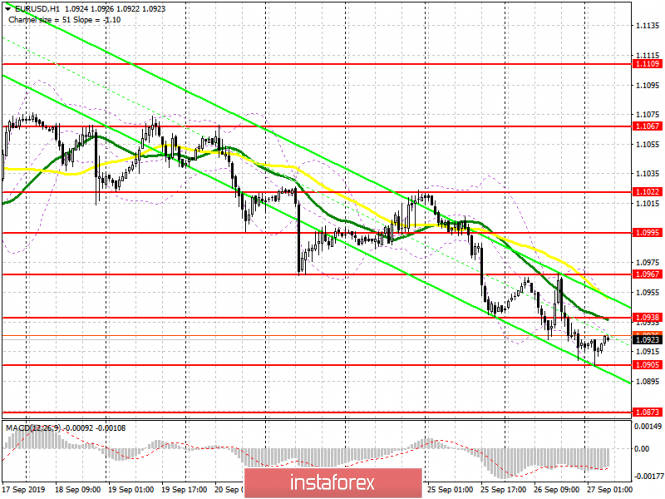

Demand for the US dollar remains quite high. Yesterday's data on the growth of the US economy and Fed representatives' statements only put pressure on the EUR/USD pair, which updated annual lows in the region of 1.0900. Currently, an important task for buyers is to keep the euro above the level of 1.0905, and only the formation of a false breakdown there will be the first signal to open long positions in the expectation of a return to resistance at 1.0938, above which a larger upward correction can be expected. The key target of the bulls will be a high of 1.0967, where I recommend taking profits. In the scenario of a further decline in EUR/USD in the morning on a trend below the level of 1.0905, it is best to open long positions by a rebound from a low of 1.0873.

To open short positions on EURUSD you need:

A report on inflation in Italy and data on the indicator of consumer confidence in the eurozone are expected in the morning. Weak statistics will lead to the formation of a false breakdown in the resistance area of 1.0938, which will be the first signal to open new short positions in order to break through and consolidate below the level of 1.0905, which will provide an influx of new euro sellers. The main task of the bears will be a test of lows in the areas of 1.0873 and 1.0840, where I recommend taking profits. In the scenario of buyers returning to the market and rising above resistance at 1.0938 in the morning, it is best to return to short positions by a rebound from the high of 1.0967, however even this will not lead to a break in the current downward trend.

Signals of indicators:

Moving averages

Trading is conducted below 30 and 50 moving averages, which indicates a bearish nature of the market.

Bollinger bands

In the event of EUR/USD decline in the morning, a break of the lower boundary of the indicator in the region of 1.0905 will increase pressure on the euro. Growth will be limited by the upper level at 1.0960.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20