To open long positions on EURUSD you need:

Euro buyers managed to pull the market off the low of the week on Friday amid a report on investor confidence, which slightly increased, but the general background remains negative. Today's report on activity in the manufacturing sector of the eurozone countries may continue to pull down the pair. Therefore, it is best to consider long positions after correction and the formation of a false breakdown in the support area of 1.0997, and buy EUR/USD immediately for a rebound from a low of 1.0960. The main goal will be to return and consolidate above the resistance of 1.1034, which will allow the bulls to update a larger range of last week's resistance in the area of 1.1067-1.1074, where I recommend taking profits.

To open short positions on EURUSD you need:

Weak production activity and the formation of a false breakdown in the resistance area of 1.1034, where the moving averages are concentrated, can lead to the formation of a new downward wave in EUR/USD, which will lead to a test of last week's low at 1.0997 and its breakthrough. Only such a scenario will increase pressure on the euro and pull down the pair to a support of 1.0960 and 1.0927, where I recommend taking profits. If the data on the eurozone does not come out as bad as expected, then the bulls can return to their resistance at 1.1034. In this case, it is best to consider new short positions in EUR/USD for a rebound from last week's resistance range in the region of 1.1067-1.1074.

Signals of indicators:

Moving averages

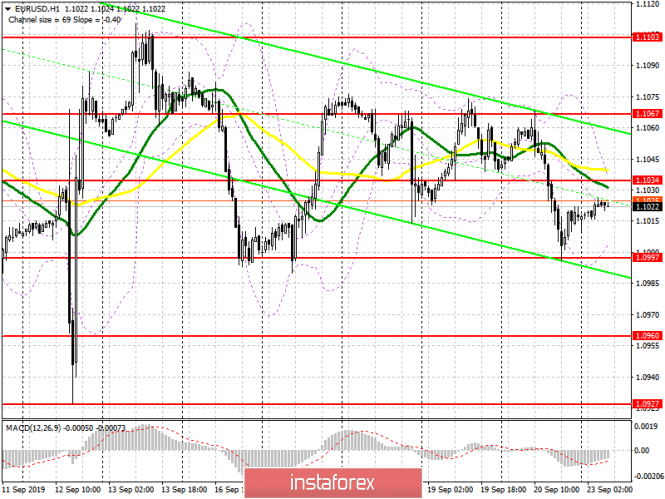

Trading is conducted below 30 and 50 moving averages, which indicates a slight superiority of euro sellers.

Bollinger bands

A break of the lower boundary of the indicator at 1.1005 will increase pressure on the euro, while the upper boundary at 1.1040 will limit the upward potential in the morning.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20