The results of the FOMC meeting caused noticeable disappointment in the markets, but did not go beyond the most likely scenario. The result of the two-day meeting was the refusal of the Fed to recognize the slowdown in the US economy, and the rise in the dollar and the fall in stock markets.

Therefore, the Fed lowered the rate by 0.25% and completed the QT program ahead of schedule, while the interest rate on excess reserves of commercial banks was reduced to 2.10%. The balance was also shifted to greater rigidity, which had a negative impact on the markets. J. Powell explained at the press conference that the current decline is a one-time action, and we are not talking about the beginning of a new cycle.

But is this really the case?

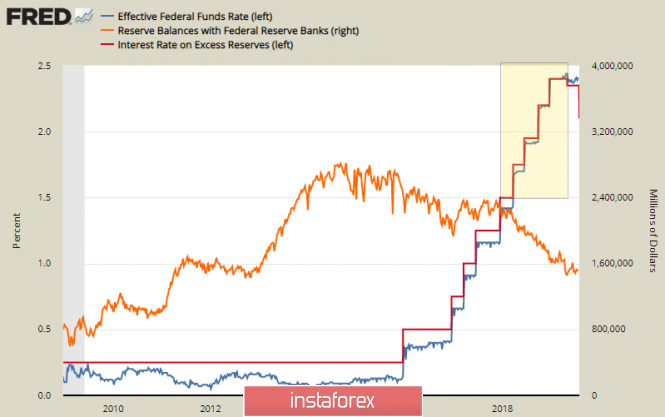

It is known that throughout the entire period of dealing with the consequences of the 2008 crisis, the rate on excess reserves of commercial banks exceeded the effective market rate. This specially created mechanism was designed to encourage commercial banks to keep excess reserves on the correspondent. Fed accounts, which, in turn, increased the balance, buying treasures and mortgage papers.

Starting from December 2015, the Fed simultaneously reduced the spread between the rate of excess reserves and the effective rate, which reduced the attractiveness of this instrument for commercial banks, until finally in December 2018. Rates are not equal. This process led to the fact that commercial banks began withdrawing their funds from the Fed's accounts, which, in turn, reduced investments in securities, that is, conducted a QT program.

However, early in May, the excess reserves rate was reduced by 0.05%, and yesterday - by 0.25%, and if it continues to fall below the effective rate, the commercial banks will continue to withdraw their reserves from the Fed. How does this go together with completing a QE program? The Fed will either need to continue lowering the rate, or seek additional funds to repurchase the US government debt and simultaneously pay off liabilities to the commercial banks, which is unlikely to be done without the QE4 program.

However, the announcement of a new wave of "quantitative easing" is completely excluded. In this case, we will have to admit that the US economy is steadily slipping into recession, which is impossible primarily for political reasons. This moment was unequivocally formulated by Powell, explaining that "real economic weakness is not what we see."

At the same time, the US budget deficit continues to grow rapidly amid a decline in revenues after tax reform and rising costs, primarily not social security. In the 2nd quarter, the volume of public debt increased by 159 billion, while in the third, it is planned to grow by 433 billion since the Congress is preparing to approve a bill to abolish the threshold of public debt for two years. At the same time, foreign investors are increasingly reluctant to buy treasures. Thus, the direct buyout of state debt to the Fed is the path that the situation in the United States follows, repeating the path of the Bank of Japan.

What does this mean for the markets? Only that the initial emotional reaction will be short. Stock indexes will resume growth, while the dollar, by contrast, growth will stop. A further reduction in the rate is inevitable, as well as the inevitable resumption of government debt repurchase by the Fed.

EURUSD

The euro remains under strong pressure, against the background of the strengthening dollar, there are no internal drivers for the euro growth. Core inflation in July fell to 0.9%, which increases the chances of launching a massive ECB stimulus program in September. Today, a short pullback to 1.1105 / 10 is possible, but more likely to continue to decline. The euro also does not have supports up to 1.0850 / 70.

GBPUSD

The growing weakness of the pound is due to the increased risks of "Brexit without a deal", which, in turn, is a consequence of B. Johnson's first steps as prime minister.

The political alignment in the British Parliament is difficult. There is little chance of leaving the EU without any deal, since Johnson will not have enough support, and the case may result in the resignation of the Cabinet. Accordingly, the extension of the temporary agreement is a slightly more likely scenario, which, in turn, will extend the period of uncertainty.

Today the Bank of England will hold a regular meeting. According to the results of which, it will publish updated macroeconomic forecasts. There is no reason to expect a positive meeting, since the pound will remain under pressure. Although there may be a temporary pullback to 1.2240 / 50, growth attempts will be used for sales, and target at 1.1990.

The material has been provided by InstaForex Company - www.instaforex.com