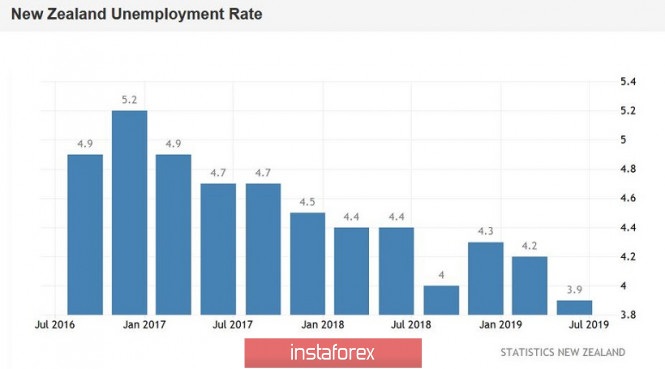

In the second quarter, New Zealand's unemployment rate fell to a record low of 3.9% compared to the forecast of growth to 4.3%. The growth rate in the number of employees also increased significantly. After reducing to -0.2%, the indicator jumped to 0.8% in quarterly terms, which has been the best result since the third quarter of last year. Likewise, the wage dynamics index showed positive dynamics as it rose to 0.8% after a three-month decline with a forecast of growth to 0.7%. In other words, almost all indicators of the New Zealand labor market came out in the "green zone" today, having unexpectedly supported the "kiwi". Yesterday, the NZD/USD pair tested annual lows in the area of 0.6480 and today, the pair jumped by almost 100 points during the Asian session.

However, the NZD/USD bulls failed to reverse the downward trend after a significant correction, the price again came under bearish pressure, despite the general weakening of the US currency. The New Zealand dollar is under severe pressure from the fundamental backdrop amid a worsening trade war between the US and China. Meanwhile, the Reserve Bank of New Zealand plans to cut interest rates already at the August meeting, which will be held tomorrow. In anticipation of this event, the NZD/USD pair clearly feels insecure. After all, the regulator is quite capable of announcing further steps to mitigate monetary policy.

It is worth recalling that not so long ago in the spring of this year, the RBNZ introduced a double mandate. The Central Bank not only provides employment but also is responsible for price stability. Moreover, if the labor market today showed positive dynamics, inflationary processes in the country leave much to be desired. Despite a slight increase in the second quarter, the consumer price index remains below the target level.

Obviously, the recent events of a geopolitical nature will also affect the dynamics of key macroeconomic indicators of New Zealand. Having a negative impact on the growth of the world economy in general and the economies of the leading countries of the world in particular, the trade war between the US and China is gaining momentum. New Zealand is no exception. China and Australia are the main trading partners of the island nation, hence the escalation of the trade conflict will affect the decisiveness of the members of the Reserve Bank of New Zealand accordingly.

Let me remind you that Beijing not only devalued its currency yesterday to 11-year lows at the level of 7,050, but also banned the import of agricultural products from the United States. These steps were a response to Trump's decision to introduce additional tariff to total of $300 billion. The American president decided to "spur" the Chinese to conclude a trade deal, but in the end he achieved the opposite result. The trade war continued, while in fact, the negotiation process came to yet another dead end.

It is apparent that the Central Bank of New Zealand will not be able to ignore all of the above trends. At the last meeting, the regulator rather restrained the risks, which provoked the growth of the national currency. At the same time, the published protocol of the last meeting of the RNBZ in June suggests that the regulator intends to further mitigate the monetary policy. In particular, the head of the Central Bank, Adrian Orr, said that if economic growth does not accelerate, then a rate cut may be required as a response. Since the last meeting, the economic situation in the country has not improved and uncertainty has only increased. Nevertheless, the Reserve Bank at its August meeting will take a "dovish" position with a high degree of probability, provoking another downward impulse for the NZD/USD pair.

According to experts, the regulator will reduce the interest rate to 1.25% tomorrow. At the same time, the Central Bank may announce further easing of monetary policy in November. In general, the rate until next spring will be reduced to 0.75% according to the expectations of many analysts. But currently, this scenario is not basic. Therefore, if the RBNZ members voice such intentions, the New Zealand dollar will significantly fall in price throughout the market, including in tandem with the US currency.

If we talk about the technical side of the issue, then here, the priority is definitely beyond at the bottom. Firstly, on the daily chart, the Ichimoku indicator formed a bearish signal "Parade of Lines", in which the price is below all its main lines and under the Kumo cloud. Secondly, the pair is between the middle and lower lines of the Bollinger Bands indicator, which also indicates a downward trend. The closest downward target at the support level of 0.6440, which is the lower line of the Bollinger Bands is on W1. However, the resistance level is the lower border of the Kumo cloud on D1, which coincides with the Tenkan-sen line at the price of 0.6600.

The material has been provided by InstaForex Company - www.instaforex.com