Forecast for August 2 :

Analytical review of H1-scale currency pairs:

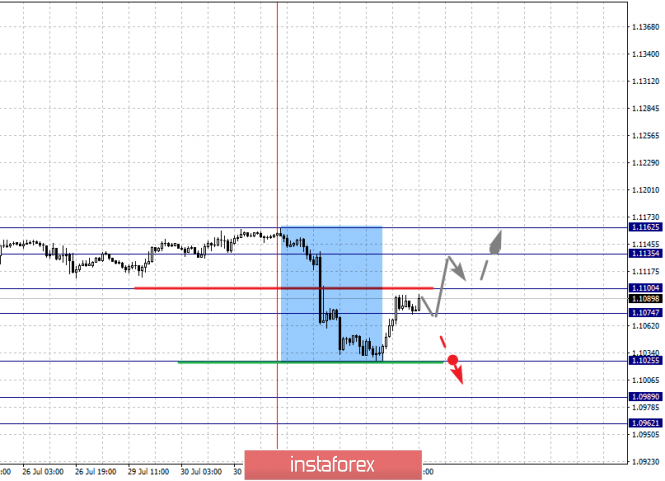

For the euro / dollar pair, the key levels on the H1 scale are: 1.1162, 1.1135, 1.1100, 1.1074, 1.1025, 1.0989 and 1.10962. Here, the price is in correction from the downward structure on July 31. The level of 1.1100 is a key support for the bottom. Its price passage will have to develop the ascending structure. Here, the first goal is 1.1135. As a potential value for the top, we consider the level 1.1162. Up to which, we expect registration of the expressed initial conditions.

The continuation to the bottom is possibly after the breakdown of the level of 1.1025. Here, the first target is 1.0989. As a potential value, we consider the level of 1.0962, and near which, we expect consolidation.

The main trend is the local downward structure of July 31, the stage of correction.

Trading recommendations:

Buy 1.1101 Take profit: 1.1135

Buy 1.1137 Take profit: 1.1160

Sell: 1.1025 Take profit: 1.0990

Sell: 1.0987 Take profit: 1.0962

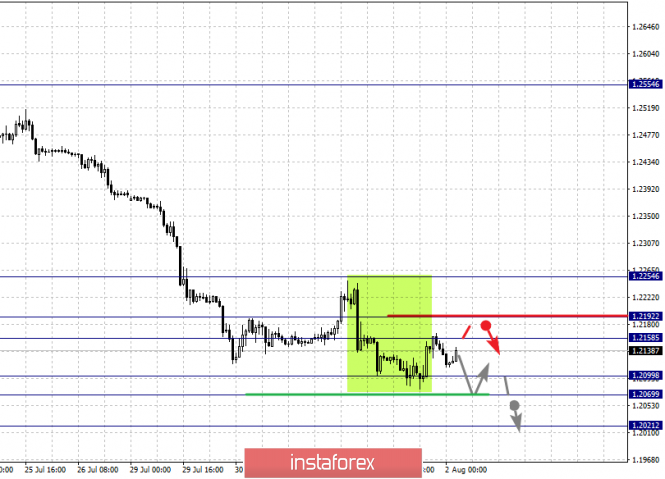

For the pound / dollar pair, the key levels on the H1 scale are: 1.2254, 1.2192, 1.2158, 1.2099, 1.2069 and 1.2021. Here, we are following a downward cycle of July 19th. Short-term movement to the bottom is expected in the range of 1.2099 - 1.2069. The breakdown of the last value will allow us to expect movement to the potential target - 1.2021. From this level, we expect a departure to the correction.

Short-term upward movement is possibly in the range of 1.2158 - 1.2192. The breakdown of the latter value will lead to the formation of the initial conditions for the top. Here, the potential target is 1.2254.

The main trend is the downward cycle of July 19.

Trading recommendations:

Buy: 1.2158 Take profit: 1.2191

Buy: 1.2194 Take profit: 1.2254

Sell: 1.2099 Take profit: 1.2070

Sell: 1.2067 Take profit: 1.2025

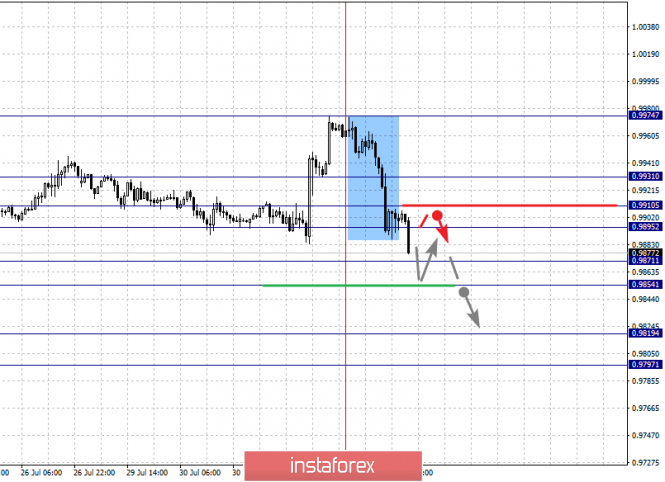

For the dollar / franc pair, the key levels on the H1 scale are: 0.9931, 0.9910, 0.9895, 0.9871, 0.9854, 0.9819 and 0.9797. Here, the price forms the downward structure of August 1. Short-term downward movement is expected in the range of 0.9871 - 0.9854. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the goal is 0.9819. For the potential value for the bottom, we consider the level of 0.9797. After reaching which, we expect consolidation, as well as rollback to the top.

Short-term upward movement is possibly in the range of 0.9895 - 0.9910. The breakdown of the latter value will lead to in-depth correction. Here, the target is 0.9931. This level is a key support for the downward structure of August 1.

The main trend is the downward structure of August 1.

Trading recommendations:

Buy : 0.9895 Take profit: 0.9910

Buy : 0.9912 Take profit: 0.9930

Sell: 0.9870 Take profit: 0.9855

Sell: 0.9852 Take profit: 0.9820

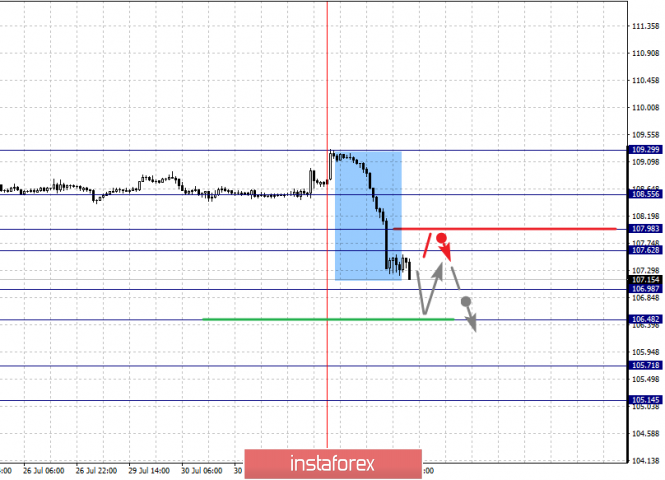

For the dollar / yen pair, the key levels on the scale are : 108.55, 107.98, 107.62, 106.98, 106.48, 105.71 and 105.14. Here, the price canceled the development of an upward trend on the H1 scale and we are following the formation of a pronounced potential for the bottom of August 1. Short-term downward movement is expected in the range of 106.98 - 106.48. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the goal is 105.71. For the potential value for the bottom, we consider the level 105.14.

Short-term upward movement is possibly in the range of 107.62 - 107.98. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 108.55. This level is a key support for the downward structure.

The main trend: the formation of the downward structure of August 1.

Trading recommendations:

Buy: 107.62 Take profit: 107.96

Buy : 108.00 Take profit: 108.55

Sell: 106.96 Take profit: 106.50

Sell: 106.45 Take profit: 105.71

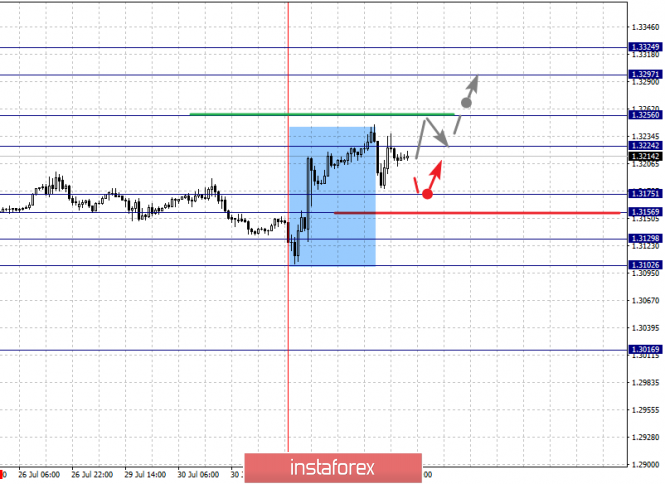

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3324, 1.3297, 1.3256, 1.3224, 1.3175, 1.3156, 1.3129 and 1.3102. Here, we continue to monitor the local ascending structure of July 31. The continuation of the movement to the top is expected after the breakdown of the level of 1.3224. Here, the goal is 1.3256. Consolidation is near this level. The breakdown of the level 1.3257 should be accompanied by a pronounced upward movement. Here, the target is 1.3297. We consider the level of 1.3324 to be a potential value for the top. Upon reaching this level, we expect consolidation as well as a rollback to the bottom.

Short-term downward movement is possibly in the range of 1.3175 - 1.3156. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 1.3129. This level is a key support for the top.

The main trend is the local ascending structure of July 31.

Trading recommendations:

Buy: 1.3225 Take profit: 1.3255

Buy : 1.3257 Take profit: 1.3295

Sell: 1.3175 Take profit: 1.3156

Sell: 1.3153 Take profit: 1.3130

For the pair of Australian dollar / US dollar, the key levels on the H1 scale are : 0.6857, 0.6834, 0.6817, 0.6786, 0.6761 and 0.6738. Here, the intraday price has issued a local downward structure for the subsequent movement to the bottom. The continuation of the downward trend is expected after the breakdown of the level of 0.6786. In this case, the target is 0.6761. For the potential value for the downward structure of July 31, we consider the level of 0.6738. Upon reaching which, we expect a rollback to the top.

Short-term upward movement is possibly in the range of 0.6817 - 0.6834. The breakdown of the latter value will lead to in-depth correction. Here, the target is 0.6857. This level is a key support for the downward structure.

The main trend is the downward structure of July 18, the local downward structure of July 31.

Trading recommendations:

Buy: 0.6817 Take profit: 0.6832

Buy: 0.6835 Take profit: 0.6855

Sell : 0.6788 Take profit : 0.6764

Sell: 0.6760 Take profit: 0.6738

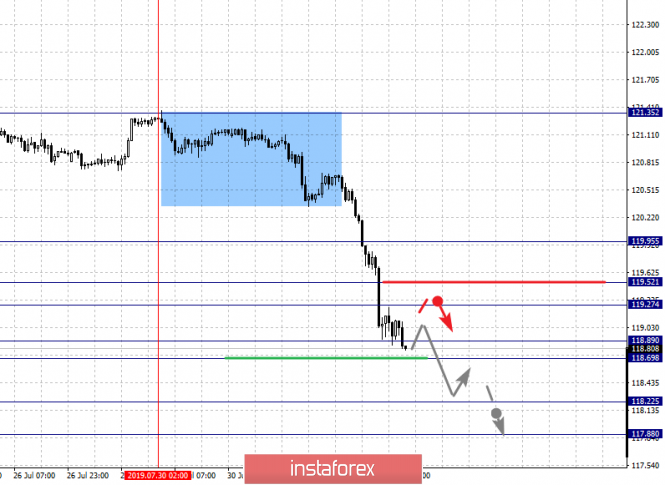

For the euro / yen pair, the key levels on the H1 scale are: 119.95, 119.52, 119.27, 118.89, 118.69, 118.22 and 117.88. Here, we are following the development of the downward cycle of July 30th. The continuation of the movement to the bottom is expected after the passage of the price of the noise range 118.89 - 118.69. In this case, the first goal - 118.22. For the potential value for the downward structure, we consider the level of 117.88. After reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is possibly in the range of 119.27 - 119.52. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 119.95. This level is a key support for the downward structure.

The main trend is the downward cycle of July 30th.

Trading recommendations:

Buy: 119.27 Take profit: 119.50

Buy: 119.55 Take profit: 119.90

Sell: 118.67 Take profit: 118.24

Sell: 118.20 Take profit: 117.90

For the pound / yen pair, the key levels on the H1 scale are : 131.10, 130.61, 130.30, 129.80, 129.51, 128.98 and 128.30. Here, the price has issued a local structure for the downward movement of July 31. The continuation of the movement to the bottom is expected after the price passes the noise range 129.80 - 129.51. In this case, the goal is 128.98. Consolidation is near this level. For the potential value for the downward trend, we consider the level of 128.30. Upon reaching this level, we expect a rollback to the top.

Short-term upward movement is possibly in the range of 30.30 - 130.61. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 131.10. This level is a key support for the bottom.

The main trend is the local downward structure of July 31.

Trading recommendations:

Buy: 130.30 Take profit: 130.60

Buy: 130.63 Take profit: 131.10

Sell: 129.50 Take profit: 129.00

Sell: 128.95 Take profit: 128.30

The material has been provided by InstaForex Company - www.instaforex.com