To open long positions on EURUSD, you need:

Yesterday's European Central Bank protocols made it clear that the leadership is not going to delay the easing of monetary policy, which hit the euro. At the moment, buyers can count on the formation of a false breakdown in the support area of 1.1066, but there is very little hope for this. The larger levels for opening long positions in EUR/USD will be the new lows of the month around 1.1028 and 1.0990. Also, the task of buyers will be to return to the resistance level of 1.1106, the breakthrough of which will provide a larger upward correction to the maximum area of 1.1130, where I recommend taking the profit. In the case of weak data on Germany, the output of which is scheduled for the first half of the day, it is best to postpone long positions on the euro until the speech of the Fed Chairman.

To open short positions on EURUSD, you need:

The sellers of the euro are faced with the task of overcoming the support of 1.1066, the repeated test of which will certainly lead to its breakdown and further movement of EUR/USD down to the area of the minimum of 1.1028. However, the larger downward trend to the support area of 1.0990, where I recommend taking the profit, will be directly related to the speech of the head of the Federal Reserve, which will take place in the afternoon. In the euro growth scenario, short positions can still be considered on a false breakdown from the level of 1.1104, or sell on a rebound from a larger resistance of 1.1130.

Indicator signals:

Moving Averages

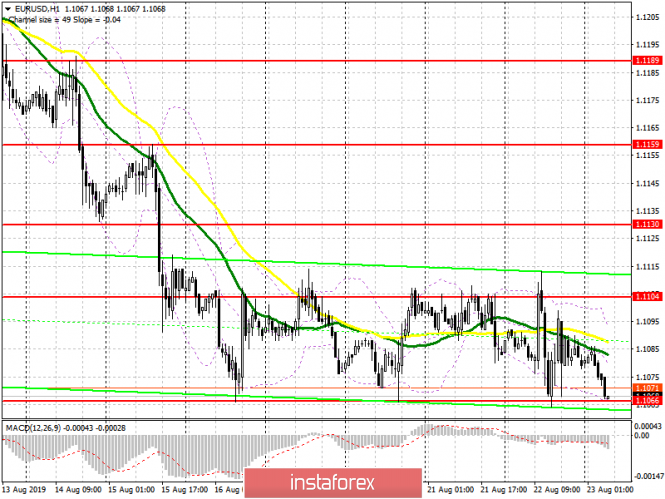

Trading is below 30 and 50 moving averages, which indicates a return to the market of euro sellers.

Bollinger Bands

The break of the lower limit of the indicator in the area of 1.1066 will strengthen the bearish trend, while the growth will be limited by the upper limit in the area of 1.1105.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20