Forecast for July 10:

Analytical review of H1-scale currency pairs:

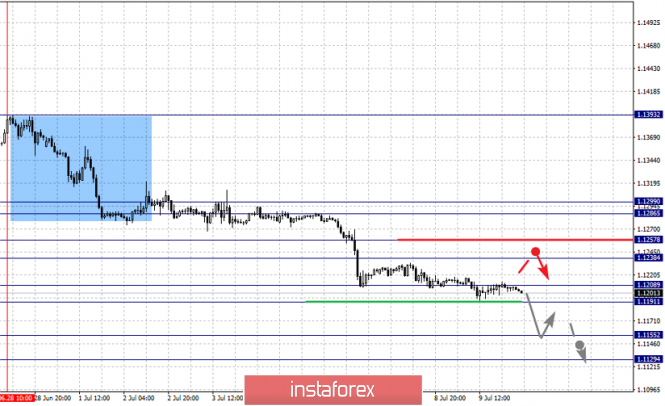

For the euro / dollar pair, the key levels on the H1 scale are: 1.1299, 1.1286, 1.1257, 1.1238, 1.1208, 1.1191, 1.1155 and 1.1129. Here, we continue to monitor the downward structure of June 28. The consolidated movement is expected in the range of 1.1208 - 1.1191. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 1.1155. We consider the level of 1.1129 to be a potential value for the bottom. After reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the range of 1.1238 - 1.1257. The breakdown of the latter value will lead to in-depth correction. Here, the target is 1.1286. The range of 1.1286 - 1.1299 is a key support for the downward structure.

The main trend - a local downward structure of June 28.

Trading recommendations:

Buy 1.1238 Take profit: 1.1255

Buy 1.1258 Take profit: 1.1285

Sell: 1.1208 Take profit: 1.1192

Sell: 1.1189 Take profit: 1.1155

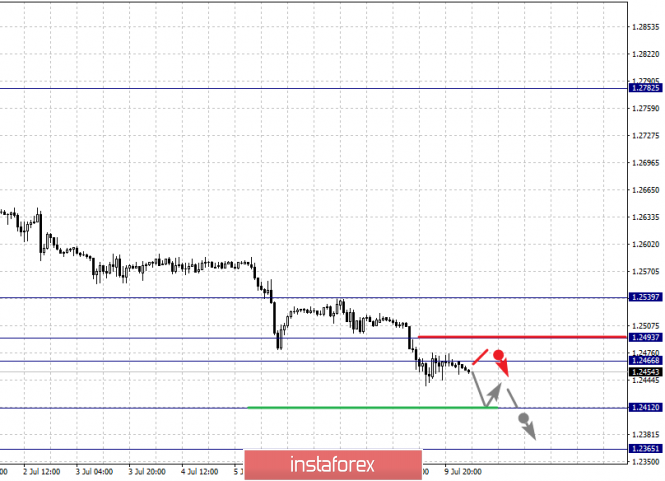

For the pound / dollar pair, the key levels on the H1 scale are: 1.2539, 1.2493, 1.2466, 1.2412 and 1.2365. Here, we are following the development of the downward structure of June 25th. At the moment, we expect a movement to the level of 1.2412. For the potential value for the bottom, we consider the level of 1.2365. The movement to which is expected after the breakdown of the level of 1.2410.

Short-term upward movement is expected in the range of 1.2466 - 1.2493. The breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2539. This level is a key support for the downward structure.

The main trend - the downward structure of June 25.

Trading recommendations:

Buy: 1.2466 Take profit: 1.2490

Buy: 1.2495 Take profit: 1.2538

Sell: 1.2412 Take profit: 1.2467

Sell: 1.2464 Take profit: 1.2367

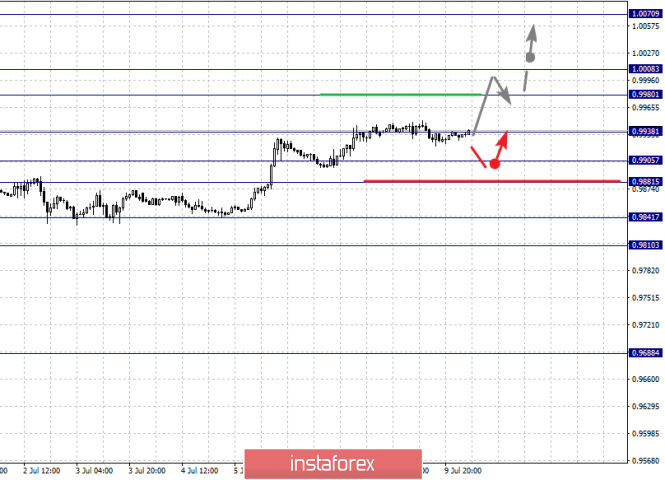

For the dollar / franc pair, the key levels on the H1 scale are: 1.0070, 1.0008, 0.9980, 0.9938, 0.9905, 0.9881, 0.9841 and 0.9810. Here, we continue to follow the development of the ascending cycle of June 25. The continuation of the movement to the top is expected after the breakdown of the level of 0.9938. In this case, the target is 0.9980. Price consolidation is in the range of 0.9980 - 1.0008 and hence, there is a high probability of going into a correction. For the potential value for the top, we consider the level of 1.0070.

Short-term downward movement is possible in the range of 0.9905 - 0.9881. The breakdown of the last value will lead to a prolonged correction. Here, the target is 0.9841. This level is a key support for the top. Its price will have the formation of the initial conditions for the downward cycle 0.9810.

The main trend is the ascending cycle of June 25.

Trading recommendations:

Buy : 0.9939 Take profit: 0.9980

Buy : 0.9982 Take profit: 1.0008

Sell: 0.9905 Take profit: 0.9883

Sell: 0.9878 Take profit: 0.9844

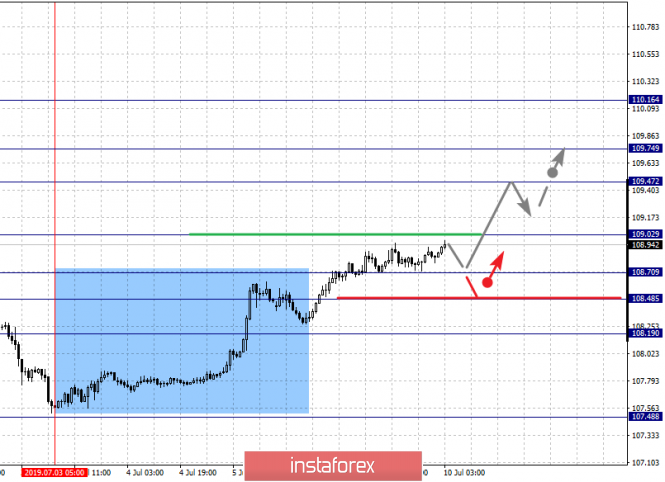

For the dollar / yen pair, the key levels on the scale are : 110.16, 109.74, 109.47, 109.02, 108.70, 108.48 and 108.19. Here, the subsequent targets for the upward trend, we have determined from the local ascending structure on July 3. The continuation of the movement to the top is expected after the breakdown of the level of 109.02. In this case, the target is 109.47. Short-term upward movement, as well as consolidation is in the range of 109.47 - 109.74. For the potential value for the top, we consider the level of 110.16. After reaching which, we expect a rollback to the bottom.

Short-term downward movement is possible in the range of 108.70 - 108.48. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 108.19. This level is a key support for the top.

The main trend: the ascending structure of June 25.

Trading recommendations:

Buy: 109.02 Take profit: 109.45

Buy : 109.48 Take profit: 109.72

Sell: 108.70 Take profit: 108.52

Sell: 108.46 Take profit: 108.20

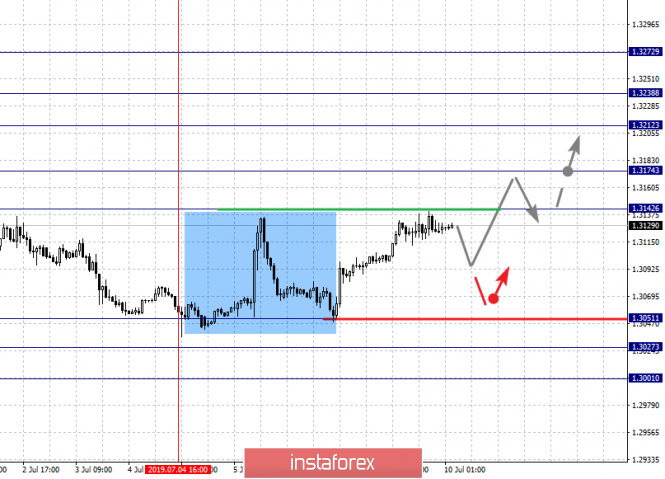

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3272, 1.3238, 1.3212, 1.3174, 1.3142, 1.3051, 1.3027 and 1.3001. Here, the price forms the potential for an upward movement of July 4. The continuation of the movement to the top is expected after the breakdown of the level of 1.3142. In this case, the target is 1.3174, wherein consolidation is near this level. The breakdown of the level of 1.3175 will lead to a pronounced movement. Here, the target is 1.3212. A short-term upward movement, as well as consolidation is in the range of 1.3212 - 1.3238. For the potential value for the top, we consider the level of 1.3272. After reaching which, we expect a rollback to the bottom.

The level of 1.3051 is a key support for the ascending structure. Its breakdown will lead to movement to level 1.3027. For the potential value for the bottom, we consider the level of 1.3001.

The main trend is the formation of potential for the upward trend of July 4.

Trading recommendations:

Buy: 1.3142 Take profit: 1.3172

Buy : 1.3176 Take profit: 1.3212

Sell: 1.3050 Take profit: 1.3028

Sell: 1.3025 Take profit: 1.3001

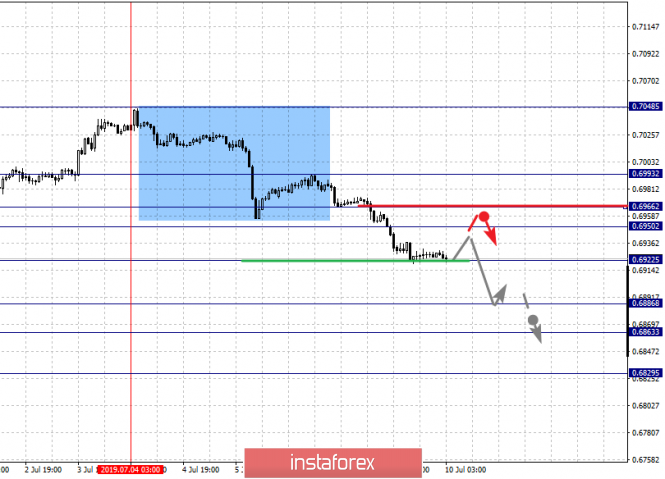

For a pair of Australian Dollar / US dollar, the key levels on the H1 scale are : 0.6993, 0.6966, 0.6950, 0.6922, 0.6886, 0.6863 and 0.6829. Here, we are following the development of the downward structure of July 4th. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6920. In this case, the target is 0.6886. Short-term downward movement, as well as consolidation is in the range of 0.6886 - 0.6863. For the potential value for the downward trend, we consider the level of 0.6829. After reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is possible in the range of 0.6950 - 0.6966. The breakdown of the last value will lead to a deep correction. Here, the target is 0.6993. This level is a key support for the downward structure.

The main trend is the downward structure of July 4th.

Trading recommendations:

Buy: 0.6950 Take profit: 0.6965

Buy: 0.6968 Take profit: 0.6990

Sell : 0.6920 Take profit : 0.6888

Sell: 0.6885 Take profit: 0.6864

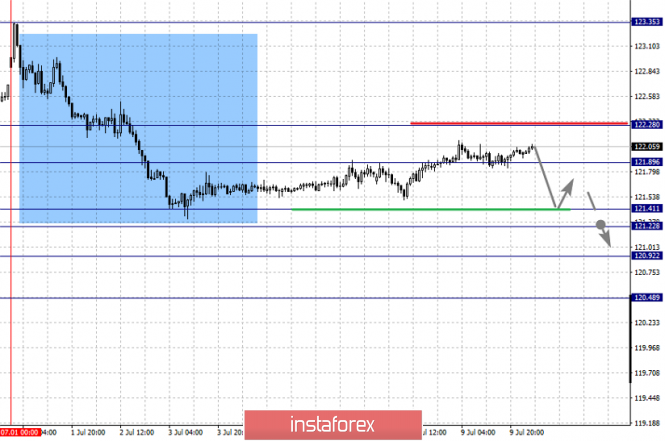

For the euro / yen pair, the key levels on the H1 scale are: 122.28, 121.89, 121.67, 121.41, 121.22, 120.92 and 120.48. Here, we continue to follow the downward cycle of July 1. At the moment, the price is in deep correction. The continuation of the movement to the bottom is expected after the price passes by the noise range 121.41 - 121.22. In this case, the target is the level of 120.92, and near this level, there is consolidation. For the potential value for the bottom, we consider the level of 120.48. After reaching which, we expect a rollback to the top.

The consolidated movement is possible in the range of 121.89 - 122.28. The level of 122.28 is a key support for the downward structure. Its price passage will have to form the initial conditions for the upward cycle.

The main trend is the downward cycle of July 1, the stage of deep correction.

Trading recommendations:

Buy: Take profit:

Buy: 121.94 Take profit: 122.28

Sell: 121.22 Take profit: 120.94

Sell: 120.90 Take profit: 120.50

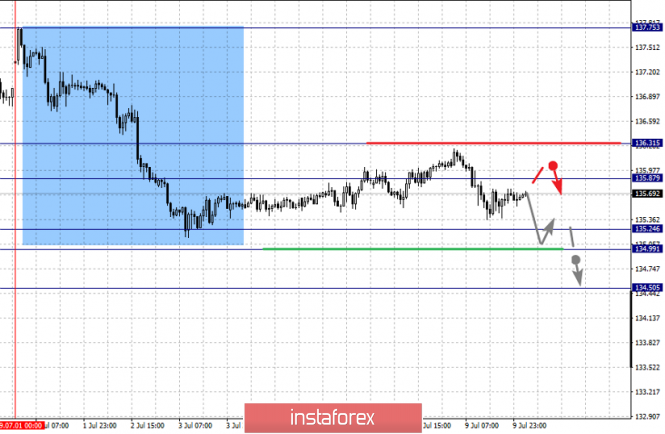

For the pound / yen pair, the key levels on the H1 scale are : 136.31, 135.87, 135.65, 135.24, 134.99 and 134.50. Here, we continue to monitor the downward cycle from July 1. At the moment, the price is in the correction zone. Short-term downward movement is expected in the range of 135.24 - 134.99. The breakdown of the last value will allow to expect movement towards a potential target - 134.50. After reaching this level, we expect a rollback to the top.

Short-term upward movement is possible in the range of 135.87 - 136.31, and up to the level of 136.31, we expect the potential for the upward cycle to be formalized.

The main trend is the downward cycle of July 1, the stage of correction.

Trading recommendations:

Buy: 135.90 Take profit: 136.30

Sell: 135.24 Take profit: 135.00

Sell: 134.95 Take profit: 134.50

The material has been provided by InstaForex Company - www.instaforex.com