The Australian labor market data released today has supported the Australian dollar. This allowed the AUD/USD bulls to remain within the 70th figure, although their position looks rather unstable. However, the price overcame the key resistance level at the end of last week, which allows the buyers to go further towards the borders of the 71st figure. So far, it's too early to talk about such price heights, given the wave-like interest of traders in the US currency and the ambiguous abstracts of the minutes of the last meeting of the Reserve Bank of Australia.

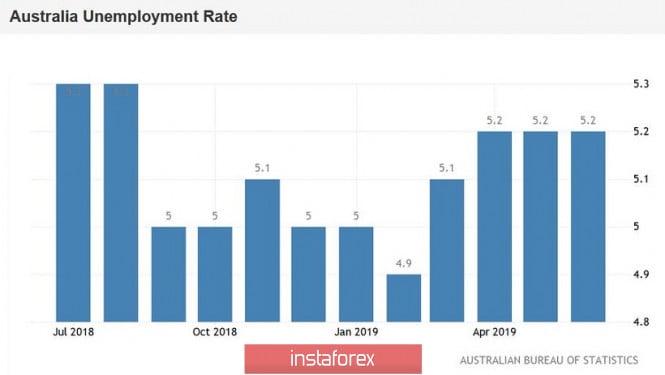

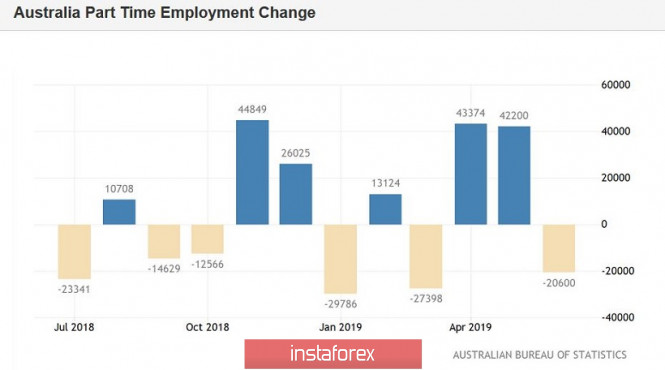

By the way, today's release is also ambiguous. The unemployment rate turned out to be at the forecast level of 5.2% and at this point, the indicator is already out for the third month in a row. I recall that at the beginning of the year unemployment was at the level of five percent. In February, it declined to 4.9% but then stabilized at around 5.2%. However, the increase in the number of employees came out in the "red zone". After substantial growth in May (+45 thousand) and rather weak forecasts for June (+9 thousand), the indicator showed a completely ugly result at first glance with the figure of +0.5 thousand. However, considering the structure of this indicator, we can conclude that not everything is so bad.

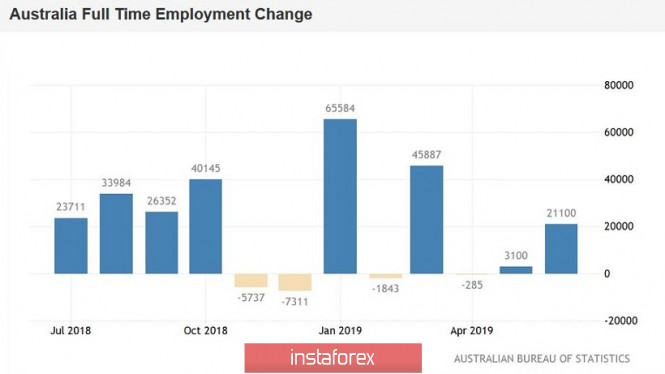

The fact is that the negative dynamics of employment growth was only due to the reduction in part-time employment. This component collapsed by 20.6 thousand but on the contrary, full employment showed a positive trend, rising by 21.1 thousand. This trend may have a positive impact on the dynamics of wage growth since full-time jobs tend to offer higher wages and a higher level of social security. The share of the economically active population was also at a fairly high level as the indicator remained at its annual maximum of 66%, repeating the success of the month before last.

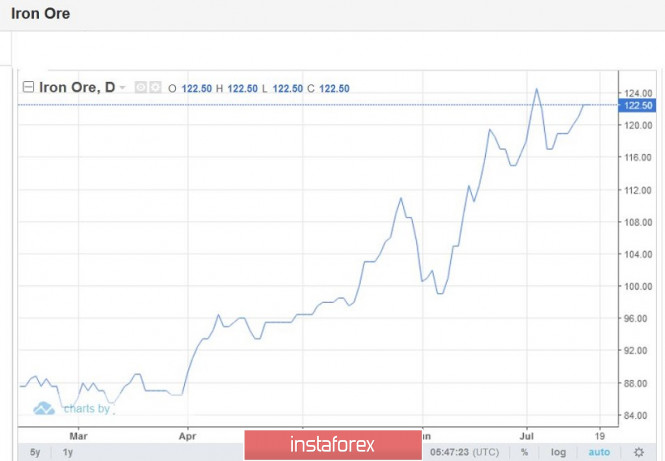

In addition to data on the labor market, other releases have helped the Australian dollar today. In particular, we are talking about the indicator of confidence in the business environment of NAB (National Australia Bank). According to experts of this largest Australian bank, consumer confidence increased by 6 points in the second quarter. This is despite the fact that the indicator has consistently and quite rapidly decreased over the past four quarters. Also, it turned out to be in the negative area in the first quarter of this year for the first time in many years. This result is due to the period of "thaw" in relations between the United States and China, as well as the significant increase in the commodity market, primarily, iron ore.

In general, the releases published today are positive. It is worth noting that under the current conditions each publication with a "plus sign" is important. By lowering the interest rate at the beginning of June (for the second time in half a year), the Reserve Bank of Australia made it clear that further steps by the regulator will depend on the incoming data, especially in the labor market. There is also no consensus among experts on the third rate cut before the end of this year. Therefore, the figures released today allow us to hope that the balance of the RBA will be inclined to the option of a waiting position.

Returning to the RBA protocol published last week, two nuances are worth noting. First, the regulator acknowledged that the effect of monetary policy easing "is unevenly spread across different households". Secondly, the Central Bank sees the need to improve the situation on the labor market primarily in the context of wage growth. All of these suggest that the next reduction in interest rates will be a difficult decision for the RBA given the presence of "side effects". While the growth of full employment in June is intended to correct the situation with a weak increase in wages towards improvement.

In other words, the Australian quite reasonably reacted to them with growth despite the apparent ambiguity of the figures published today. In addition, "Aussie" receives background support from the commodity market. The cost of iron ore is still above $120 per ton. Iron ore futures on the Dalian commodity exchange rose this week by 1.1% to 131.63 dollars per ton. Earlier this week, growth reached 3.3% and the price increased to a record high since December 2013. It is worth recalling that the mining sector in Australia is 10% of GDP, and the economic sectors that are associated with mining (where iron ore occupies a central place) account for another 9% of GDP.

Thus, the AUD/USD pair quite "deservedly" consolidated within the 70th figure, although further growth (for the time being) is limited by the nearest resistance level of 0.7060, which is the top line of the Bollinger Bands indicator on D1). Further large-scale growth of the pair depends only on the behavior of the US currency, which as a result, depends on the next steps of the Fed and (possibly) the White House. Rumors that Donald Trump will decide on foreign exchange interventions are increasingly being discussed among experts. Hence, this scenario cannot be ruled out, especially if the Fed takes a "not enough dovish" position at its July meeting. The support level for the AUD/USD pair is the mark of 0.6940, which is the lower limit of the Kumo cloud on the daily chart.

The material has been provided by InstaForex Company - www.instaforex.com