The Canadian dollar gained momentum and closed with a bearish daily candle yesterday after. However, the US dollar still remains the dominant currency in the pair.

Ahead of the FOMC meeting today, USD slightly gave in to CAD trying to establish a strong bullish trend in the pair. Some experts think that the Fed is expected to give details on the upcoming rate cuts in today's meeting. The US dollar may be affected by the Fed's decision. Financial markets have gotten used to the Federal Reserve adjusting its benchmark interest rate in small increments. The target range for the federal funds rate currently stands at 2.25% to 2.5%, which means the Fed many not have enough ammunition to fight a full-blown recession. That makes it more important for the Fed to be aggressive when it cuts, getting the most impact out of every step downward. Federal Reserve inflation running persistently below the Fed's 2% target, and inflation expectations falling, that means the potential negative consequences of cutting too much are meaningfully reduced. The Fed is less likely to unleash unwanted higher inflation with aggressive cuts.

At the extreme, that sort of volatility could feed into the real economy and make the Fed's job in coming weeks even more complicated. The federal funds rate has been unchanged since December after a three-year cycle of monetary policy tightening that began slowly but ended with roughly quarterly rate hikes over 2017 and 2018. Additionally, US Building Permits report was published. The reading was unchanged 1.29M. Economists expected the value to increase to 1.30M. The reading of Housing Starts report decreased to 1.27M from 1.28M but performed better than expected.

On the other hand, today Canadian CPI report is going to be published. The figure which is expected to drop to 0.1% from the previous value of 0.4%, Common CPI is expected to grow to 1.9% from the previous value of 1.8%, Median CPI is expected to be unchanged at 1.9% and Trimmed CPI is also expected to be unchanged at 2.0%. Ahead of the G20 meeting, the Canadian government is going to speak with US senator about the upcoming trade conditions. The Oil Sector and Housing market have started to stabilize which indicates a strong boost in the domestic market. Amid such news, the Canadian dollar may increase profits.

As of the current scenario, CAD is expected to regain and sustain the bearish momentum against USD. As the Fed clears the doubts, the pair is expected to create a certain direction.

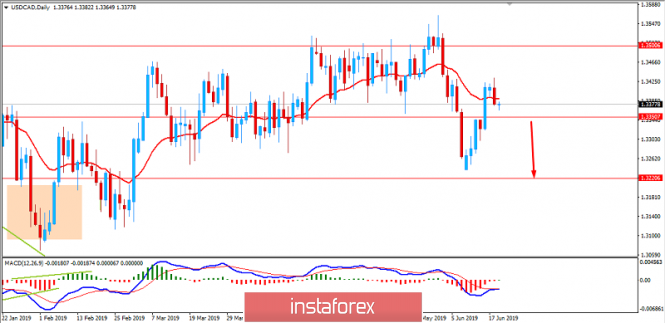

Now let us look at the technical view. The price is currently residing above 1.3350 support area after an impulsive bearish daily close. If it creates a way for the price lower, then the price is expected to push towards 1.3200-20 support area. Though the pair has been quite volatile, the FOMC meeting's outcome today is expected to put pressure on the pair.