USD has gained momentum against GBP recently which lead the price to break below 1.30 area with a daily close. It is a sign of further bearish momentum for the coming days. The British pound fell a bit initially to kick off the trading session on Monday as China announced further tariffs against the US.

The GBP/USD pair continues to trade in a 30-pips narrow range heading into early European session. Looking ahead, the UK jobs data may have limited impact on the spot, as the overall market sentiment will remain affected by Brexit and trade risk situation. Today, the UK Average Earnings Index report is going to be published which is expected to decrease to 3.4% from the previous value of 3.5%. Besides, the unemployment rate is expected to be unchanged at 3.9%. Furthermore, the claimant count change data is expected to be favorable with a decrease to 24.2k from the previous figure of 28.3k.

On the other hand, the downbeat economic reports from the US and the ongoing trade war with China may lead to further weakness in USD. Investors fear that the United States and China may be spiraling into a fiercer, more protracted dispute that could derail the global economy. It led to a sharp selloff in the equities markets in the past week. Minneapolis Fed President Neel Kashkari said: "If it's the worst-case scenario and it's ever-increasing tariffs for an extended period of time, that could change things, that could have a real effect on U.S. GDP growth." A closely watched spread between long- and short-term bonds turned negative, seen by some officials as a sign of weakened market confidence in the economic outlook.

Today, the US NFIB Small Business Index report is going to be published which is expected to increase to 102.3 from the previous figure of 101.8 and the import prices is likely to show an increase to 0.7% from the previous value of 0.6%. Moreover, FOMC Members George and Williams are going to speak today but these event will have a minor impact on the US dollar exchange rate. This week's high impact economic news is going to be the US retail sales report which is to be published on Wednesday. Experts predict that the retail sales decreased to 0.2% from the previous value of 1.6%.

As of the current scenario, the UK high impact economic reports may lead to certain gains on the GBP side if the outcome surpasses expectations, whereas the weaker USD may lead to further correction and volatility in the pair. The long-term bias is still favoring USD but certain gains on the GBP side are expected before the trendy bearish momentum strikes again.

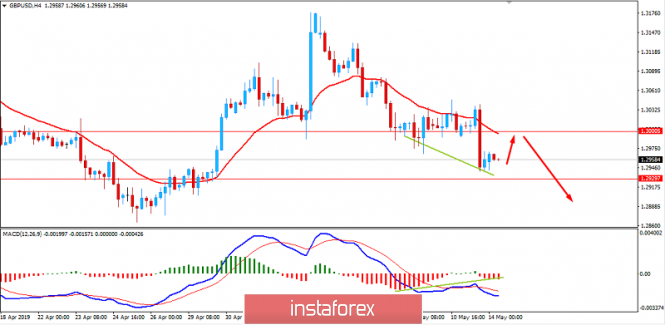

Now let us look at the technical view. The price has formed the Bullish Divergence pattern while pushing below 1.30 area. The price may rise higher towards 1.30 again before any bearish signs show up to push the price lower in the coming days. As the pair remains below 1.30 area with a daily close, further bearish momentum is expected to gain pressure with the target towards 1.2850 support area.