EUR is expected to be quite volatile this week as the economic calendar is loaded with macroeconomic reports and events which are meaningful for both EUR and USD.

The EU regultor is quite concerned about the economic slowdown in the eurozone's economy. Indeed, all the countries in the European Union is struggling to maintain momentum. According to European Commission's vice president Valdis, Italy may be forced to freeze some of its plans for public expenditures as the country's growth is slower than forecasted. Additionally, the European Commission is going to set priorities for the eurozone's budget for all countries. However, some of the countries need separate budgets that might create internal conflicts in the euro area.

On Wednesday, the ECB main refinancing rate statement is going to be published which is expected to be unchanged at 0.00% along with Monetary Policy Statement which is expected to be neutral as well. The ECB Press Conference will be held following the statement. The events of major importance for EUR will clear up market sentiment about EUR. Investors assume the ECB to unveil its assessment and forecasts for thr eurozone's economy.

On the other hand, USD has been weighed down by mixed economic reports. However, USD managed to sustain momentum over EUR. Therefore, EUR is losing favor with investors. Recently US Average Hourly Earnings report was published. The average wage in the US sank to 0.1% from the previous value of 0.4% which was expected to be at 0.3%. The unemployment rate remained unchanged as expected at 3.8%. On the plus side, the non-farm employment change was better than expected with a surge to 196k from the previous figure of 33k which was expected to be at 172k.

So, the Employment Change came in beyond expectations. On the flip side, averge hourly earnings eased notably last month that casts a shadow over the US labor market. This week FOMC Meeting Minutes along with Federal Budget Balance report are going to be published on Wednesday. Federal Budget Balance is expected to contract to -194.7B from the previous figure of -234.0B. Moreover, on Thursday US PPI report is going to be published with factory inflation increasing to 0.3% from the previous value of 0.1%. FOMC Members Clarida and Bullard are due to speak about current and future monetary policy and short-term interest rate decisions.

Meanwhile, experts do not rule out even a rate cut by the Federal Reserve this year. The US central bank views the labor market as a key criterion for policy decisions. So, mixed employment data released on Friday assures the Fed to adop a patient approach. At the same time, EUR is unable to regain its momentum due to a series of downbeat data from the eurozone.

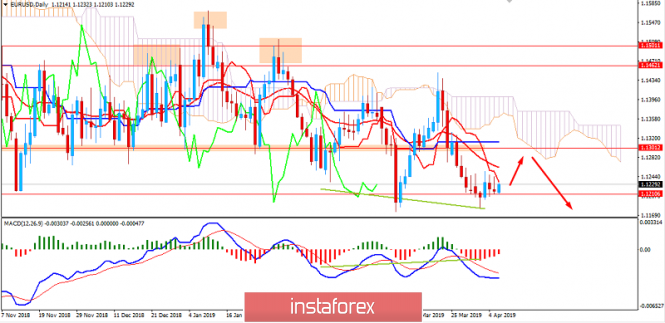

Now let us look at the technical view. The price is currently climbing higher after consolidating and rejecting off the 1.1200 support area for a few days now. The price could rise higher towards 1.1300 from where the price is going to trade under bearish pressure. As the price remains below 1.1300 with a daily close, the bearish bias is likely to persist.