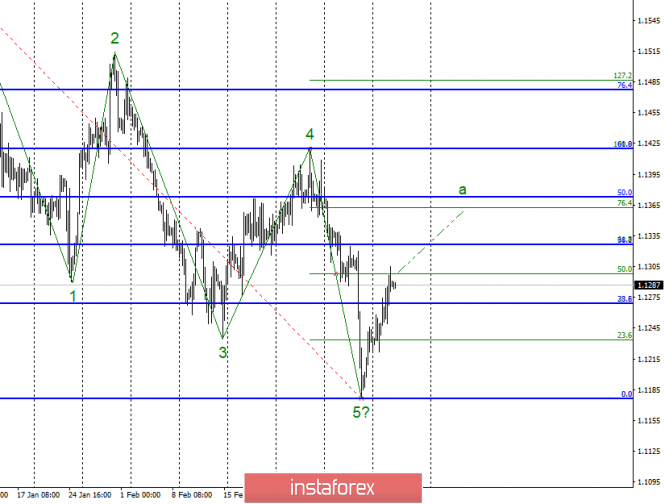

Wave counting analysis:

On Tuesday, March 12, trading ended for EUR / USD by another 40 bp increase. Thus, the tool continues to build the expected wave of a new uptrend trend. If this assumption is true, then the increase in quotes will continue with targets located near the levels of 61.8% and 76.4% on the small Fibonacci grid. The news background for the pair remains relatively neutral upon which, at least sharp price fluctuations are not caused by it. An unsuccessful attempt to break through the 50.0% Fibonacci level may throw the pair down a bit. The backup option implies a serious complication of the downward trend section. And it will be possible to return to it after breaking through the minimum of wave 5.

Sales targets:

1.1176 - 0.0% Fibonacci

Shopping goals:

1.1326 - 61.8% Fibonacci

1.1362 - 76.4% Fibonacci

General conclusions and trading recommendations:

The pair allegedly completed building wave 5. Thus, only a breakthrough of 127.2% Fibonacci level will return us to sales. Now, I recommend to continue to buy a pair with targets located near the estimated marks of 1.1326 and 1.1362, based on the construction of the upward wave 1 or a. For greater persuasiveness in the execution of this option, I recommend waiting for a successful attempt to break through the level of 50.0%.

The material has been provided by InstaForex Company - www.instaforex.com