GBP has been quite strong versus JPY despite BREXIT-related jitters which could affect GBP gains in the coming days. Japan is facing economic slowdown and declining exports that is certainly bearish for JPY.

As for BREXIT, the quesion is still uncertain whether the UK will leave the EU with a deal, without a deal or Brexit will be delayed. A delay has created a dilemma in the market sentiment recently. BREXIT is going to produce the enormous impact on the financial industry, so the BOE is currently trying to prepare them with proper guidance along the way before the banks are hurt by the negative consequences. The UK Parliament voted several times on whether to ask the EU for an extension of the BREXIT deadline. After a series of rejection, the decision is passed with majority vote recently. The positive vote assured GBP buyers that theyh should not be afraid of sudden GBP weakness. However, GBP could lose momentum as the days progress.

On the other hand, the Bank of Japan kept monetary policy unchanged today but moderated its optimism as soft exports and factory output are going to affect the domestic economy. The risk is still there as the fragile economic recovery is going to derail the overall process of regaining momentum. Today the BOJ also made optimistic comments on stable economic growth despite certain obstacles like soft export sales. The regulator consider this to be temporary as measures are being taken to prop up the economy. The BOJ Policy Rate was published unchanged at -0.10% today. The BOJ has to solve a problem as Factory Output and Exports slumped in the recent months. Massive money printing dried up the market and may cause the economic downturn in the future.

Meanwhile, GBP is still being under pressure due to the BREXIT uncertainty. GBP may show certain weakness in the coming weeks. On the other hand, JPY is also weak, but it could regain momentum thanks to the BOJ optimism. If BREXIT is delayed, GBP is not going to suffer a major blow like a No-Deal BREXIT, but it is going to lose ground in the medium term.

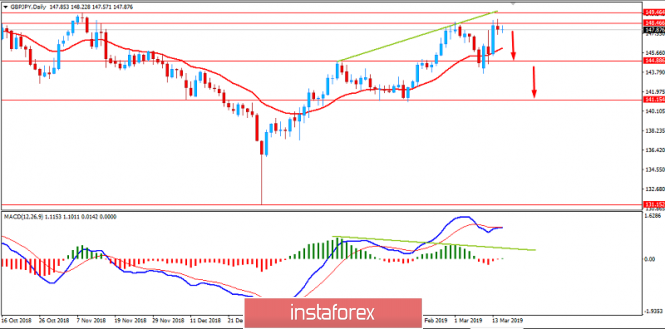

Now let us look at the technical view. The price formed a Bearish Divergence from 148.50-149.50 resistance area from where a bearish candle is expected to lead the price lower towards 145.00 support area in the coming days in a volatile trade. As the price remains below 150.00 area with a daily close, the pair will have chances of a bearish counter-move.