AUD has been the dominant currency in the pair despite the worse economic reports and dovish bias in the market as Eurozone facing the economic slowdown and BREXIT issues on the line.

Eurozone has been facing somw headwinds. One of them is the looming BREXIT which is slated for March 29th 2019. Brexit is likely to cause damage both to the UK economy and the eurozone's economy. The European Union recently agreed to give the financial sector an extra two years to comply with new rules aiming to avoid repetition of attempts to rig the Libor interest rate benchmark. Today M3 Money Supply report is going to be published which is expected to decrease to 4.0% from the previous value of 4.1% and Private Loans is expected to increase to 3.4% from the previous value of 3.3%. Moreover, German Buba President Weidmann is going to speak today regarding the eurozone's key interest rate and further monetary policy. The ECB gives the neutral assessment of the upcoming development while working on the pan-European banks creation which is supported by central bank's governors and ECB policymakers. EUR is going to trade with higher volatility in the coming days.

On the AUD side, today Australia's Construction Work Done report was published with a slight increase to -3.1% from the previous value of -3.6%, much weaker than the forecast of a 0.6% gain. Construction spending in Australia took a surprise spill last quarter with a disappointing reading which indicates that the Australian economy is currently facing some headwinds. The value is the lowest since 2017 and such downside risk is expected to affect the GDP forecast for the year. According to Westpac Senior economist Andrew Hanlan, bottlenecks are a constraint or it may have been weather disruption. The Reserve Bank of Australia presented a bearish outlook for the domestic economy that might lead to 2 rate cuts this year which would lead to further AUD weakness.

Tomorrow Australia's Private Capital Expenditure report is going to be published which is expected to increase to 0.8% from the previous value of -0.5% and Private Sector Credit is expected to increase to 0.3% from the previous value of 0.2%. Both economic reports could reveal positive readings which may encourage strength for AUD. However, any worse print is expected to weaken AUD momentum.

As of the current scenario, AUD is slightly firmer than EUR fundamentally. So, AUD managed to gain momentum despite tepid economic reports from Australia and the eurozone. Ahead of BREXIT, weakness on EUR is quite logical as investors are flocking to safe haven assets to avoid significant shocks in the market by being biased towards EUR.

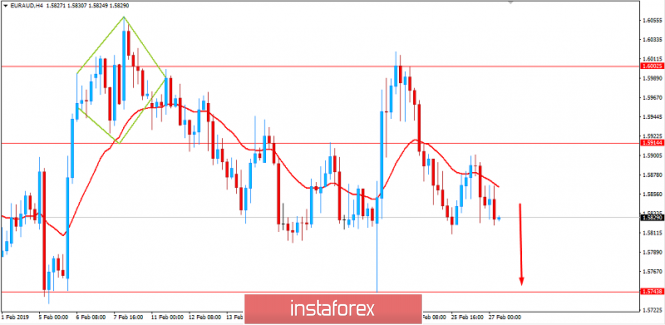

Now let us look at the technical view. The price has been quite volatile while pushing lower after retracing towards 1.5900 area with a daily close. As per current price formation, the price is expected to push lower towards 1.5750 support area in the coming days though certain correction and volatility may be observed along the way.