EUR/AUD has been quite volatile recently. The price is heading towards 1.6750, but closed below 1.6350 with a daily close. Despite an empty economic calendar in the eurozone and Australia, such volatility in the pair is quite surprising.

Australia lacks any economic reports or events today. Nevertheless, AUD is being dominated by EUR quite easily. Yesterday, bullish pressure was unusual which faded away quite quickly. Today French Prelim CPI report is going to be published which is expected to increase to 0.1% from the previous value of -0.2%, Spanish Services PMI is expected to decrease to 53.8 from the previous figure of 54.0, Italian Services PMI is expected to decrease to 50.2 from the previous figure of 50.3, French Final Services PMI is expected to increase to 49.7 from the previous figure of 49.6, German Final Services PMI is expected to be unchanged at 52.5, German Unemployment Change is expected to increase to -12k from the previous figure of -16k, and the eurozone's Final Services PMI is expected to be unchanged at 51.4. Moreover, the eurozone's Flash CPI is expected to decline to 1.8% from the previous value of 2.0%, Core Flash CPI is expected to be unchanged at 1.0%, PPI is expected to decrease to -0.2% from the previous value of 0.8%, and Italian Prelim CPI is expected to increase to 0.1% from the previous value of -0.2%.

Meantime, EUR is quite vulnerable amid the upcoming economic reports. The pessimistic market sentiment is expected to encourage gains on the AUD side. AUD is currently silent amid the empty economic calendar. On the other hand, EUR has been weighed down by downbeat economic reports and German strike issue. So, investors shift focus towards AUD in the coming days.

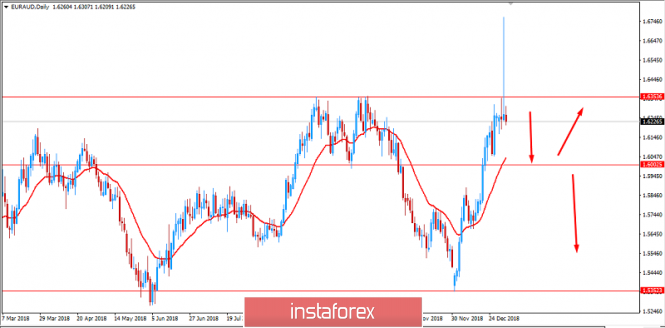

Now let us look at the technical view. The price is currently trading lower after an impulsive bullish rejection or bearish pressure that is expected to push the price lower towards 1.60 support area in the coming days. If the price manages to break below 1.60 with a daily close, further bearish momentum is expected with a target towards 1.5350. Otherwise, a rejection off the 1.60 area is expected to lead the price higher towards 1.6350 area again in the coming days. As the price remains above 1.60 with a daily close, the bullish bias is expected to continue.

SUPPORT: 1.5350, 1.5500-50, 1.60

RESISTANCE: 1.6350, 1.6500, 1.6750

BIAS: BULLISH

MOMENTUM: VOLATILE