NZD/JPY has been quite volatile at the edge of 77.50 area while pushing higher since bouncing off 72.50 area earlier. Amid downbeat economic reports from New Zealand, NZD is currently struggling to sustain the bullish momentum over JPY which might lead to certain counter in the process.

NZD has been weakened by recent economic data. Risk aversion is expressed by the authorities of RBNZ which also determines market sentiment on NZD. Recently New Zealand Retail Sales report was published with a decrease to 0.0% from the previous value of 1.1% which was expected to be at 1.0%, Trade Balance increased to -1,295M from the previous value of -1,596M which failed to meet the expectation for an increase to -850M and ANZ Business Confidence report was published unchanged at 37.1. Moreover, RBNZ Financial Stability Report and RBNZ Governor Orr spoke about the ease of New Zealand's financial system risks that is expected to lead to better financial position of the country. Today Business Confidence report was published with an increase to 1.5% from the previous value of -1.3%.

On the other hand, on the back of positive reports from Japan JPY gained momentum, defending against NZD bulls quite well. Recently Japan's Retail Sales report was published with an increase to 3.5% from the previous value of 2.2% which was expected to be at 2.7%. Today Tokyo Core CPI report was published unchanged at 1.0% which was expected to increase to 1.1%, Unemployment Rate increased to 2.4% which was expected to be unchanged at 2.3%, and Prelim Industrial Production increased to 2.9% from the previous value of -0.4% which was expected to be at 1.3%. Additionally, Consumer Confidence report is yet to be published today which is expected to edge up to 43.3 from the previous figure of 43.0 and Housing Starts is expected to increase to 0.4% from the previous negative value of -1.5%.

Meanwhile, JPY is holding the upper hand over NZD despite mixed economic data and optimistic expectations of pending reports, though deeper pullback could happen along the way. Until New Zealand comes up with better economic data or news, JPY is expected to lead the way with a bearish counter-move in the coming days.

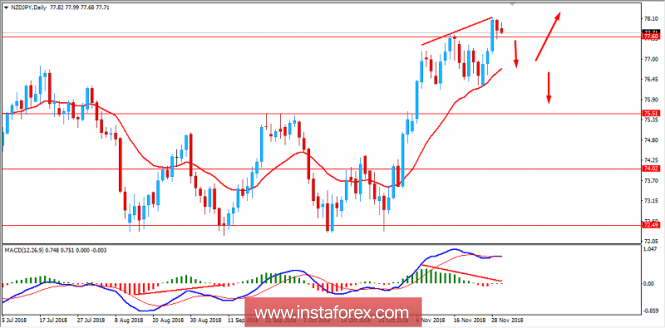

Now let us look at the technical view. The price has been bearish with the recent daily close after breaking above 77.50 area with a daily close. As for the current price formation, it is expected to push lower towards 77.00 area having a Bearish Regular Divergence which might lead to a further downward movement towards 75.50 support area in the coming days. As the trend is quite strong with the bullish momentum, there are certain chances of the price to bounce back higher after retracing towards 77.00 area where the dynamic level of 20 EMA lies. As the price remains above 75.00 area, the bullish bias is expected to continue.

SUPPORT: 75.00-50, 76.50, 77.50

RESISTANCE: 78.50, 80.00

BIAS: BULLISH

MOMENTUM: VOLATILE