NZD/JPY has been quite impulsive with the bullish trend earlier. However, the pair has turned quite volatile after being rejected off the 77.50 resistance area with a daily close. Amid upbeat economic reports, NZD is currently expected to make a downward correction before the price continues impulsively again in the coming days.

NZD has been quite firm in light of the recently published economic reports which propped up currency to dominate JPY. Recently New Zealand PPI Input report was published with an increase to 1.4% from the previous value of 1.0% which was expected to decrease to 0.8%, PPI Output report was published with an increase to 1.5% which was expected to be unchanged at 0.9%, and Visitors Arrival also increased to 4.0% from the previous value of -1.7%. The positive economic reports provides a required push for NZD to gain momentum but was not sufficient for the currency to sustain the momentum over USD ahead of the imminent Rate Hike.

On the other hand, while JPY is struggling amid the Japanese financial sector's issues, it managed to gain momentum on the back of BOJ Governor Kuroda's speech on slowing down bond purchases with the view of accelerating inflation. The hawkish statement by Kuroda about the economic development provided the required momentum. However, a decline in the pair may lead to long-term weakness JPY in the future.

Meanwhile, JPY is expected to gain certain momentum over NZD. As NZD is quite strong fundamentally, it is expected to climb higher in the long term, while the slowdown process may lead to certain weakness on the JPY side. Upcoming economic reports from Japan and New Zealand are sure to determine a further direction of the pair.

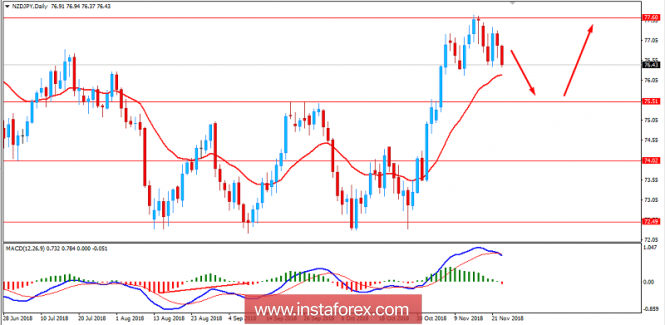

Now let us look at the technical view. The price is currently pushing lower after an impulsive bullish pressure towards 77.50 area. The price forming Bearish Divergence is expected to lead to certain bearish momentum towards 75.50 support area from where the price is expected to continue pushing higher as per recent impulsive trend momentum. As the price remains above 75.00 area with a daily close, the bullish bias is expected to continue.

SUPPORT: 74.00, 75.00-50

RESISTANCE: 77.50, 78.50, 80.00

BIAS: BULLISH

MOMENTUM: VOLATILE