EUR / USD

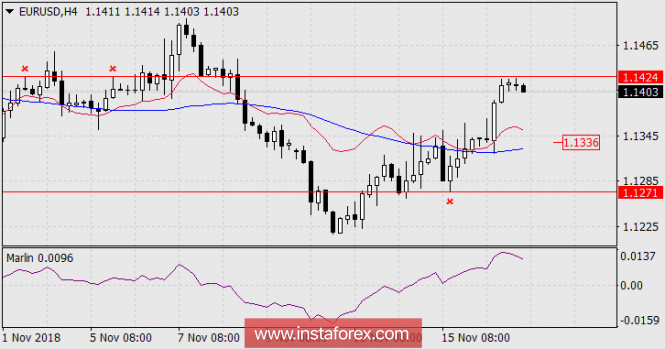

On Friday, the euro rose to the target level of 1.1424 despite the discrepancies in macro statistics in the euro area and the US and despite political tensions in Italy and the prospects for reaching agreements on trade between the US and China. Italy's trade balance for September worsened from 2.49 billion euros to 1.27 billion while industrial production in the United States increased by 0.1% in October, and capacity utilization was 78.4% against expectations of 78.3%.

On the daily and H4 charts, the Marlin oscillator signal line turns down. We believe that Friday's growth against the data is complete. Today, the euro zone's balance of payments for September will be published. The forecast is 24.2 billion euros against 23.9 billion. But even if it comes out worse than the forecast, it can be easily shifted from the focus of investor attention or by the ECB's financial stability report. In example, statements from Mario Draghi who promised to continue to stimulate until the eurozone economy stabilizes, he speech of the head of the Federal Reserve Bank of San Francisco, John Williams, who can confirm Friday's statements by Kaplan and Evans about a 3-4 rate increase next year or also it may be a statement by the European Commission on the budget of Italy on Wednesday, it could be the case on the background.

As the main scenario, we expect the euro to decline from the current level to the support of the Krusenstern line on H4 - 1.1336. This level coincides with the minimum of 26 October, overcoming the target level will allow the euro to decline to 1.1271.

The material has been provided by InstaForex Company - www.instaforex.com