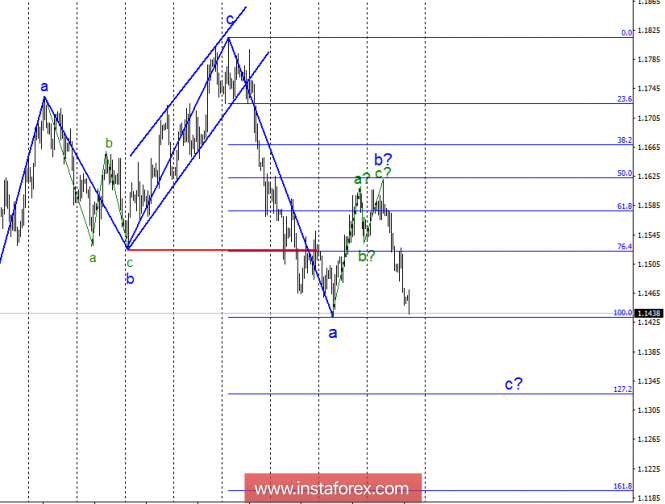

Wave counting analysis:

In the course of trading on Thursday, the EUR / USD currency pair lost about 50 basis points. Thus, the pair is supposedly continuing to build wave c. If this is indeed the case, the decline in quotations will continue with targets located near the calculated levels of 127.2% and 161.8% on the Fibonacci grid, built on the size of wave b. An unsuccessful attempt to break through the 100.0% Fibonacci mark can lead to a departure of quotes from the lows reached and the construction of an internal correctional wave c.

The objectives for the option with sales:

1.1327 - 127.2% of Fibonacci

1.1194 - 161.8% of Fibonacci

The objectives for the option with purchases:

1.1622 - 50.0% of Fibonacci

General conclusions and trading recommendations:

The currency pair supposedly completed the construction of wave b. Thus, now I recommend selling the pair with targets located near the estimated marks of 1.1327 and 1.1194, which corresponds to 127.2% and 161.8% in Fibonacci. There are no grounds for assuming a change in the working version. The outcome of the EU summit does not give reason to expect the growth of the pair.

The material has been provided by InstaForex Company - www.instaforex.com