GBP/JPY has recently broken below the corrective range support area of 147.00 from where the price is expected to push lower in the coming days. As of the recent worse economic reports of GBP, in the meantime, JPY gained good momentum in the process which is expected to lead to further bearish pressure in the pair for the coming days.

This week GBP CPI report was published with a decrease to 2.4% from the previous value of 2.7% which was expected to be at 2.6%, and Retail Sales also decreased significantly to -0.8% from the previous value of 0.4% which was expected to be at -0.4%. As of the BREXIT impact and certain indecision throughout the economy, GBP is currently struggling to gain in the process. Today Bank of England's Governor Carney is going to speak about short-term interest rates and upcoming decisions for the economy which is expected to have a neutral impact on the upcoming gains of the currency in the market.

On the other hand, JPY has been quite positive with the economic report this week including the Trade Balance report not meeting the worse expected figure of -0.34T from the previous figure of -0.19T but actually resulting to -0.24T, and Bank of Japan's Governor's speech having hawkish indication for the upcoming developments in the economy and how well their plan worked to stabilize the trade and commerce in the economy. Today the JPY National Core CPI report was published with an increase to 1.0% as expected from the previous value of 0.9%, and Bank of Japan's Governor spoke about the protectionism and upcoming increase in volatility despite the expansion of the financial market. The speech was quite hawkish but with a certain warning about the upcoming volatility which might lead to uncertainty in the process.

As of the current scenario, JPY is fundamentally stronger than GBP which might lead to certain gains on the JPY side for the coming days, but certain caution should be also maintained as the price may be volatile and corrective along the way to move downward in the process. Until GBP comes up with a better economic outcome, JPY gains are expected to expand further in the future.

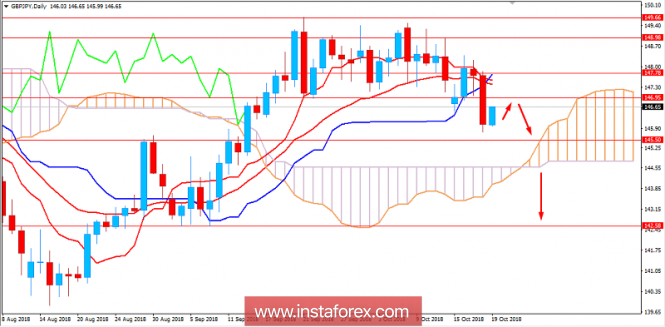

Now let us look at the technical view. The price breached below the 147.00 area with a strong bearish daily close recently which is expected to lead to further bearish pressure in the pair. Though certain bullish pressure can be observed currently in the pair as the price remains below the 148.00 area, the bearish bias is expected to continue and push the price lower towards 145.50 and later towards 142.50 support area in the coming days.

SUPPORT: 142.50, 145.50

RESISTANCE: 147.00, 148.00

BIAS: BEARISH

MOMENTUM: VOLATILE