AUD/USD has been quite impulsive amid the bearish pressure. The pair is expected to rebound for a certain period before pushing lower again in the coming days. AUD has lost momentum against USD despite positive economic data recently that indicates the strength of USD after a rate hike ahead of the NFP reports this week.

This week AIG Manufacturing Index report was published with an increase to 59.0 from the previous figure of 56.7, MI Inflation Gauge increased to 0.3% from the previous value of 0.1% and Cash Rate remaining unchanged as expected at 1.50%. Today Australia Trade Balance report was also published with a wider surplus of 1.60B from the previous figure of 1.55B which was expected to decrease to 1.43B. Moreover, tomorrow Australia's Retail Sales report is going to be published which is expected to increase to 0.3% from the previous value of 0.0%.

On the other hand, the US is due to release economic reports, including Average Hourly Earnings which is expected to decrease to 0.3% from the previous value of 0.4%, Non-Farm Employment Change is expected to decrease to 185k from the previous figure of 201k but Unemployment Rate is expected to have positive outcome with decrease to 3.8% from the previous value of 3.9%. The expectations are quite negative for USD which might lead to certain weakness for the currency against AUD in the process. Today US Factory Orders report is going to be published which is expected to increase to 2.2% from the previous value of -0.8% and Natural Gas Storage is expected to increase to 47B from the previous figure of 46B.

Meanhwile, AUD is still quite optimistic amid the upcoming economic reports whereas expectations for the US reports are downbeat. If US economic data surpasses the expectations, further bearish pressure is expected. Otherwise, upbeat data from Australia may lead to certain counter impulsive momentum in the process.

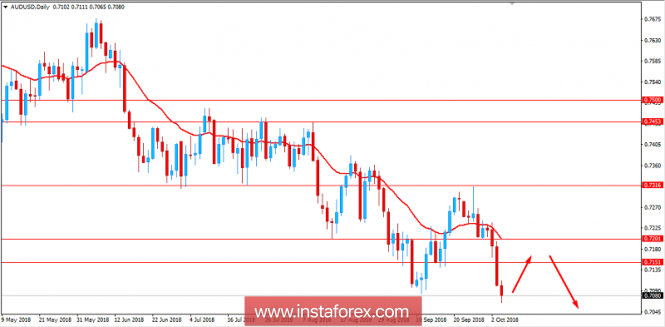

Now let us look at the technical view. The price is currently residing below the key resistance area of 0.7150-0.7200 from where certain pullback and retest is expected before the price starts to push lower again with a target towards 0.7000 and 0.6850 area in the coming days. The dynamic level is currently quite apart from the current market price and as per mean reversion, the price is expected to push higher towards the dynamic levels before pushing further with the trend in the process. As the price remains below 0.7200 area, the bearish bias is expected to continue.

SUPPORT: 0.7000, 0.6850

RESISTANCE: 0.7150, 0.7200

BIAS: BEARISH

MOMENTUM: IMPULSIVE