USD/JPY has been quite corrective and volatile recently after breaking above 110.50 area with a daily close. Currently the price is heading higher with an impulsive momentum which is expected to lead the price higher towards 112.00 and later towards 113.00 area in the future.

Ahead of the high impact economic reports on the USD side this week, certain volatility is expected in this pair whereas USD is expected to lead the way against JPY. After celebration of Labor Day, today USD ISM Manufacturing PMI Report is going to be published which is expected to decrease to 57.6 from the previous figure of 58.1. At the same time, the Construction Spending is expected to increase to 0.5% from the previous negative value of -1.1%. The ISM Manufacturing Prices index is expected to increase to 74.0 from the previous figure of 73.2, IBP/TIPP Economic Optimism is expected to decrease to 57.2 from the previous figure of 58.0 and Total Vehicle Sales is expected to have slight decrease to 16.7M from the previous figure of 16.8M.

On the JPY side, today the Monetary Base report was published better than the expected value of 6.9% while slightly decreasing from the previous value of 7.0% which was expected to decrease to 6.3%. Moreover, on Friday Japan's Household Spending report is going to be published which is expected to increase to -0.8% from the previous value of -1.2% and the Average Cash Earnings is expected to decrease to 2.4% from the previous value of 3.3%.

As of the current scenario, ahead of the high impact economic reports like NFP this week, USD is forecasted to have mixed economic reports whereas JPY is expected to have dovish outcomes as well. Though JPY has been quite successful holding USD gains in the process, but any positive outcome of the upcoming high impact economic reports is expected to inject further gains for the USD side in the process leading to more upward momentum.

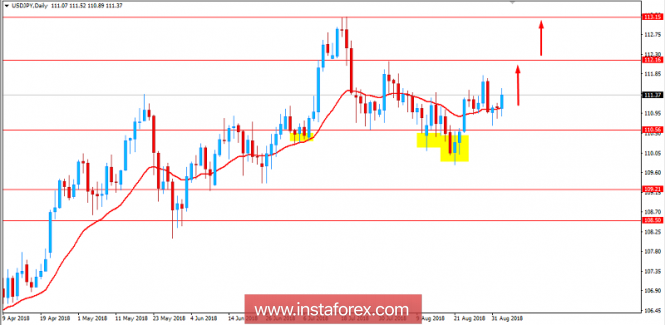

Now let us look at the technical view. The price is currently residing above the dynamic level of 20 EMA while also residing above 110.50 area with a daily close. After the recent false breakouts below 110.50 area, the current bullish momentum is expected to push towards 112.00 area and later towards 113.00 area in the coming days. As the price remains above 110.50 area with a daily close, the bullish bias is expected to continue.

SUPPORT: 110.50, 109.20, 108.50

RESISTANCE: 112.00, 113.00

BIAS: BULLISH

MOMENTUM: VOLATILE