GBP/USD has been quite bullish and volatile recently which lead the price to reside and reject from the edge of 1.3050 area. USD has been the dominant currency in the pair earlier but despite the positive employment reports published recently, USD could not sustain the bearish pressure it had over GBP in the process.

Yesterday, a positive GDP report did help GBP to gain the required momentum after having a certain volatile affair with USD after the Employment Change reports published on Friday. UK GDP rose to 0.3% from the previous value of 0.1% which was expected to be at 0.2%. Moreover, Goods Trade Balance, Construction Output and Index of Services reports were also better than a forecasted value which leads GBP to gain impulsively over USD in the process. Today Average Earning Index report was also published with an increase to 2.6% which was expected to be unchanged at 2.4% but Claimant Count Change had negative impact performing worse than expected at 8.7k which was expected to decrease to 6.9k from the previous figure of 10.2k and Unemployment Rate was unchanged as expected at 4.0%.

On the USD side, there have been no impactful economic reports published after the Friday's NFP reports for which no certain momentum on the USD side was observed so far. Today, the USD Final Wholesale Inventories report is going to be published which is expected to be unchanged at 0.7% and JOLTS Job Opening is expected to increase to 6.68M from the previous figure of 6.66M. Ahead of the PPI, CPI and Retail Sales reports to publish this week, certain volatility and indecision can be expected on the USD side as the forecasts are quite mixed.

As of the current scenario, GBP had a setback today after providing series of positive high impact economic reports whereas USD having certain high impact economic reports yet to be published, certain volatility can be observed in this pair. If USD performs better than expected with the economic reports this week, the bearish trend is expected to continue further for the coming days.

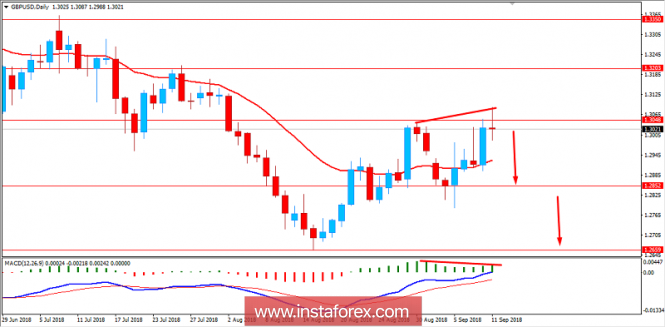

Now let us look at the technical view. The price is currently residing below 1.3050 area with a daily close while also having a bearish divergence in place signaling upcoming bearish momentum in the pair. A daily close below 1.3050 with certain bearish pressure today is expected to indicate further bearish momentum in the pair which can lead the price towards 1.2850 and later towards 1.2650 area in the coming days.

SUPPORT: 1.2850, 1.2650

RESISTANCE: 1.3050, 1.3200

BIAS: BEARISH

MOMENTUM: VOLATILE