EUR/USD has been quite volatile recently. Impulsive bearish pressure, which engulfed the previous bullish price action with a daily close, indicates further bearish momentum in the pair. Despite a series of downbeat economic reports from the US, certain impulsive gain against EUR is indeed surprising.

EUR has been quite mixed with the recently published economic reports which provides the required setback for the bears to push lower with impulsive pressure on Friday. Ahead of ECB President Draghi's speech this week, certain volatility may be observed in this pair. Today the eurozone's Final CPI report is going to be published which is expected to be unchanged at 2.0%, Final Core CPI is also expected to be unchanged at 1.0%, Italian Trade Balance is expected to decrease to 4.82B from the previous figure of 5.07B, and German Buba Monthly report is going to be published today which is expected to have a neutral impact on the currency momentum.

On the USD side, after a series of high impact downbeat economic reports like PPI, CPI and Retail Sales, USD is quite weak fundamentally and expected to remain indecisive as no high impact economic report is going to be published today. Today US Empire State Manufacturing Index report is going to be published which is expected to decrease to 23.2 from the previous figure of 25.6. Additionally, this week on Wednesday Building Permits is expected to be unchanged at 1.31M and Housing Starts is expected to increase to 1.24M from the previous figure of 1.17M

Meanhwile, market-moving event like ECB President's speech this week is expected to inject the required definite momentum for this pair. On the other hand, USD has been affected by a series of downbeat economic reports and low impact reports throughout the week. This is expected to be a setback for USD in the process.

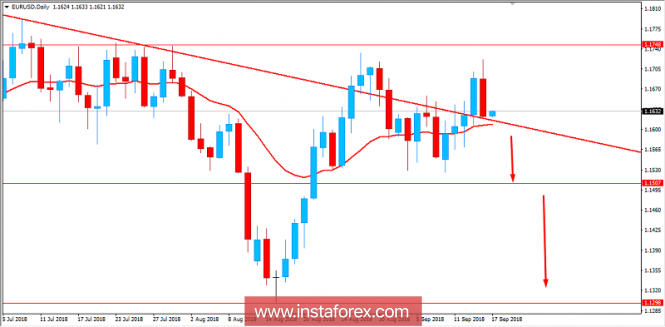

Now let us look at the technical view. The price is currently residing at the edge of Trend Line support while also having an engulfed bearish candle in the process. As the price remains above the dynamic level of 20 EMA and Trend Line support, a break with a daily close is required for the price to push much lower with a target towards 1.1500 and later towards 1.1300 area. As the price remains below 1.1750 area, the bearish bias is expected to continue further.

SUPPORT: 1.1300, 1.1500

RESISTANCE: 1.1750

BIAS: BEARISH

MOMENTUM: VOLATILE