AUD/USD has been quite impulsive with recent gains which are leading the price towards 0.7310 resistance area. AUD has been quite solid amid the recent economic reports and events, whereas USD is still struggling to gain certain momentum in light of downbeat economic reports followed.

As Australian Cash Rate was unchanged at 1.5% with the view of stabilizing the economy further and encouraging development, AUD has gained good momentum to counter the preivous bearish trend. Recently the minutes of the lateat policy meeting of the Reserve Bankof Australia were released which revealed quite hawkish stance, leading to further gains on the AUD side. Moreover, economic reports like HPI was unchanged as expected at -0.7% and MI Leading Index report was published with an increase to 0.1% from the previous value of 0.0%. Today RBA Bulletin covered certain issues like The Effect of Minimum Wage, Access to Small Business Finance, and The New Payments Platform which had positive outcome in the process.

On the other hand, today US Philly Fed Manufacturing Index report was published with a jump to 22.9 from the previous figure of 11.9 which was expected to be at 17.5 and Unemployment Claims had a positive result decreasing to 201k from the previous figure of 204k which was expected to increase to 210k. However, CB Leading Index was decreased to 0.4% from the previous value of 0.7% which was expected to be at 0.5%. Additionally, Existing Home Sales report was also published unchanged at 5.34M which was expected to increase to 5.36M.

Meanwhile, USD is still found struggling amid the mixed economic reports, whereas Australia's consistent positive economic reports helped AUD to sustain the bullish momentum it had. This week the economic calendar contains no economic reports from the US, AUD is expected to continue gaining ground against USD in the process leading to a higher price in the coming days.

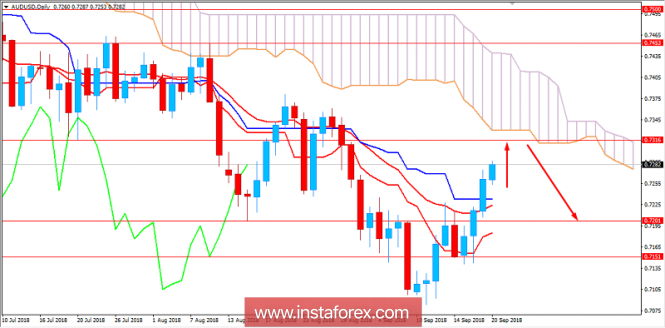

Now let us look at the technical view. The price has breached above the dynamic levels of 20 EMA, Tenkan and Kijun line with a daily close and heading towards 0.7310 area. The current momentum indicates the target area of 0.7310 is easily attainable but as of the preceding bearish trend and having strong Kumo resistance at 0.7310 area, the price is expected to push lower with target towards 0.7150-0.7200 area again in the coming days. As the price remains below 0.7450 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 0.7150, 0.7200

RESISTANCE: 0.7310, 0.7450

BIAS: BULLISH

MOMENTUM: IMPULSIVE