To open long positions for EUR / USD, you need:

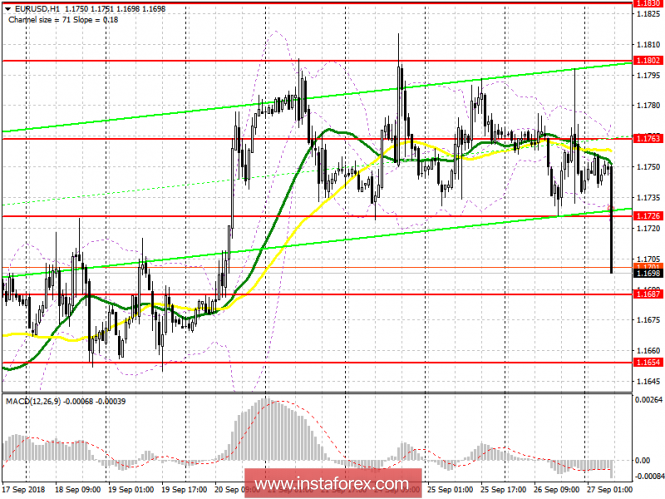

An increase in the rate of the Fed led only to the strengthening of the euro in the afternoon, but it can be seen that today, buyers quickly leave the market. To consider long positions in the euro, I recommend after the formation of a false breakdown in the support area of 1.1687 or to rebound from a new low at 1.1654. It's still early to panic EUR / USD bulls. Their main task before the end of the week will be a return to the resistance level of 1.1726, which will lead to an increase in demand for the euro and the renewal of resistances 1.1763 and 1.1802, while maintaining the uptrend.

To open short positions for EUR / USD, you need:

The sellers coped with the first task of securing below the area of 1.1726. An unsuccessful attempt to return to this level with a false break in the morning will be a good signal for the opening of short positions in EUR / USD and further decline to 1.1687 and 1.1654. The consolidation below the level of 1.1687 will indicate a complete reversal of the upward trend in the euro. In the case of growth above 1.1726 in the morning, sales can be returned immediately to a rebound of 1.1763.

Important attention today should be removed speeches of the president of the ECB and the chairman of the Federal Reserve.

Indicator signals:

Moving Averages

The 30-day moving average changes its direction down and gradually separates from the level of the 50-day average, which indicates the formation of a downward trend in the market.

Bollinger Bands

Please note that the sharp decline in the euro did not affect the Bollinger Bands indicator, which could bring EUR / USD back to the side channel 1.1726-1.1800 by the end of the day, if the situation does not change.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

The material has been provided by InstaForex Company - www.instaforex.com