The Canadian dollar came under the influence of the overall situation in the foreign exchange market. Discussion of the prospects for this or that currency pair now largely comes down to one issue that has a very distant relationship with trading - whether Turkey will release the American pastor or not. Positions of protective instruments and high-risk assets depend on the resolution of this issue. Today, the market has information that Ankara has decided to release Branson from prison on August 15 - that is, on the day when, according to rumors, the deadline for the US ultimatum to Turkey expires. And although the news is unconfirmed, traders reacted quite sharply - the European currency strengthened throughout the market, the yen began to surrender, and gold pushed off annual lows.

The Canadian currency has also suspended its decline, but in this case it should be extra cautious - even if the general fundamental background in the foreign exchange market changes (in the context of Turkish actions), the Canadian will remain under pressure from other, "personal" problems of a fundamental nature. And it's not just the uncertain dynamics of the oil market: the main risk is now related to the prospects for the North American Free Trade Agreement (NAFTA).

This week, negotiations should be resumed in a trilateral format - at least this was announced last Saturday by the Canadian ambassador to the United States. In early August, a bilateral meeting was held in Washington between representatives of the American and Mexican sides. This fact troubled traders, as rumors began circulating on the market that Canada wants to be excluded from the negotiation process altogether. But these rumors have not been confirmed yet: both Mexico and Canada are still "in the game", although it is impossible to speak with firm confidence until the beginning of the next round of talks.

Here, it is worth noting that on the eve of the trilateral talks, Donald Trump again "raised the stakes," and heated the already tense situation. He was outraged that Canada continues to keep its tariffs "at high levels," while maintaining trade barriers. He also warned that if Canadians fail the next NAFTA negotiations, then the States will invest Canada with import duties on cars. It should be noted that Trump has long been scaring Canadians with these duties. According to most experts, such a move would be a tangible blow to the Canadian economy. The fact is that the car industry of this country mainly consists of car assembly factories of a number of auto giants, such as Toyota, Honda, and Ford in particular, and exports to the United States is more than 70% of cars produced in the country for about 50 billion dollars. Therefore, if the US president realizes his plans, the consequences for Canada can be very serious, up to the recession of the economy.

This "farewell" to Donald Trump says that Canadians generally have two options: either to make concessions and largely agree to the conditions of Americans, or to prepare for the introduction of the above fees. Notably, amid constant criticism of Canada, Trump warmly began to treat Mexico, or rather, the new president of this country. Even on Saturday, voicing threats about duties, he called his Mexican colleague an "absolute gentleman." In other words, if the parties fail to reach agreement in a trilateral format, Trump will most likely leave the NAFTA in late autumn (after the midterm elections in Congress) and will renegotiate the free trade agreement with Mexico.

This fact will provide background pressure on the Canadian dollar. In addition, we must not forget that Canada has spoiled relations with Saudi Arabia, and this political conflict has not yet been exhausted. Moreover, the Canadians were left without public support, even from the closest allies. Riyadh, in turn, allows for the possibility of increasing economic pressure on Ottawa.

Thus, the uncertain prospects for NAFTA and the political conflict with Saudi Arabia have leveled off the positive effect of the success of the Canadian economy. Significant strengthening of the labor market amid a good dynamics of inflation growth allows the Bank of Canada to further tighten the terms of monetary policy, but external fundamental factors may adversely affect the resolve of the regulator's members.

In the coming days it will become clear whether Canada will return to the NAFTA negotiating table or take a different position. Depending on this decision, the vector of movement of the Canadian currency will be determined. Therefore, the current downward movement of the USD/CAD pair looks unreliable, because now the market is focused only on Turkey. As soon as the discharge in this matter follows, traders will switch to NAFTA's question, whose prospects still look foggy.

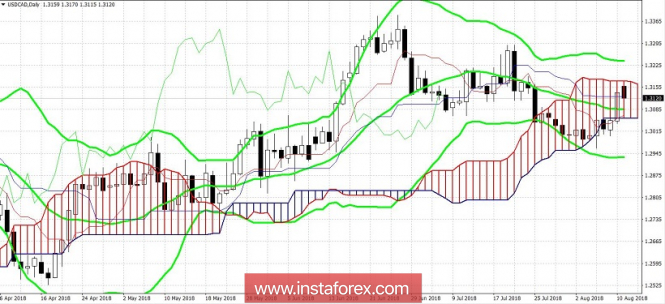

Particular care should be taken when approaching the USD/CAD. The level of 1.3050 is the lower boundary of the Kumo cloud on D1, which coincides with the Tenkan-sen line of the Ichimoku Kinko Hyo indicator. Fixing below this target bear pairs will not be easy. Therefore, in this price area, bulls can seize the initiative, especially if the uncertainty surrounding the participation of Canadians in the negotiation process for NAFTA will continue.

The material has been provided by InstaForex Company - www.instaforex.com