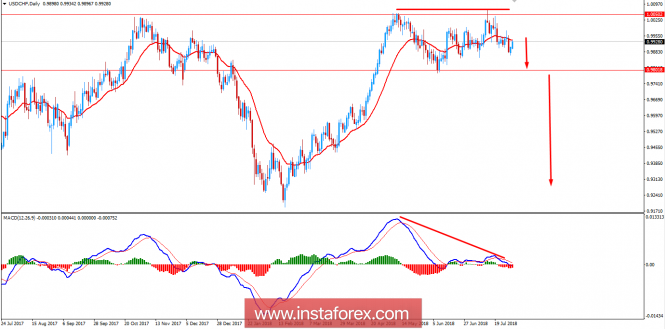

USD/CHF has been quite bearish after rejecting off the 1.0050 with a daily close having a strong bullish rejection in the process which is expected to lead the price towards 0.98 in the coming days. Though the price is residing inside the range between 0.98 to 1.0050 area for a few days now, the bears are starting to take control of the market in the process.

Ahead of the NFP report to be published this week, USD has been performing quite well currently and today USD ADP Non-Farm Employment Change report is going to be published which is expected to increase to 186k from the previous figure of 177k, ISM Manufacturing PMI is expected to slightly decrease to 59.4 from the previous figure of 60.2 and Crude Oil Inventories report is also expected to increase to -2.6M from the previous figure of -6.1M. Additionally, today FOMC Meeting Minutes is going to be held along with Federal Funds Rate decision which is expected to be unchanged at 2.00%, which might lead to certain volatility in the pair as well.

On the CHF side, this week KOF Economic Barometer report was published with a decrease to 101.1 from the previous figure of 101.3 which was expected to increase to 101.6, which affected the growth of CHF against USD in the process leading to certain bullish pressure pushing the price higher. Tomorrow CHF SECO Consumer Climate is going to be published which is expected to be unchanged at 2, Retail Sales is expected to increase to 0.0% from the previous value of -0.1% and Manufacturing PMI is expected to decrease to 60.8 from the previous figure of 61.6.

As of the current scenario, ahead of the NFP and today's Federal Funds Rate report certain volatility is expected to be observed in this pair which might lead to a break out from the range it has been residing in for a while now. Though CHF has been quite dominating over USD earlier a strong impulsive break on either side may still happen in the process. To sum up, CHF may gain further momentum against USD as no changes on the Federal Funds Rate and Neutral FOMC is expected in today's high impact economic reports.

Now let us look at the technical view. The price has been in a contraction between the range of 0.98 to 1.0050 area from while Bearish Divergence can be observed alongside signaling further move down towards 0.98 and further lower in the coming days if the price manages to break below 0.98 with a daily close. As the price remains below the 1.0050 area with a daily close, the bearish bias is expected to continue further.

RESISTANCE: 1.0050

SUPPORT: 0.9800

BIAS: BEARISH

MOMENTUM: VOLATILE