NZD/USD has been non-volatile with the recent bearish moves which led the price to reside below 0.6700 area with a daily close. USD has been outperforming in most of the major currency pairs where NZD is no different.

NZD has been struggling recently due to unchanged Official Cash Rate and dovish statements at RBNZ Press Conference. This week, NZD has been quite firm with the gains which created bullish momentum in the pair. Today, New Zealand PPI Input report was published with an increase to 1.0% from the previous value of 0.6% which was expected to decrease to 0.2% and PPI Output also increased to 0.9% from the previous value of 0.2% which was expected to decrease to 0.1%.

On the other side, recently US Retail Sales report was published with an increase to 0.5% from the previous value of 0.2% which was expected to decrease to 0.1% and Core Retail Sales also increased to 0.6% from the previous value of 0.2% which was expected to be at 0.3%. The positive readings did provide the needed boost for the currency, whereas NZD has been struggling to impress the market sentiment. Today, US Prelim UoM Consumer Sentiment report is going to be published which is expected to increase to 98.1 from the previous figure of 97.9 and CB Leading Index is expected to decrease to 0.4% from the previous value of 0.5%.

Meanwhile, USD has been performing quite well in light of recent economic reports, whereas NZD is likely to make a counter move in the context of today's economic data. Though positive economic reports from New Zealand may lead to certain gains, it is expected to be quite short-lived.

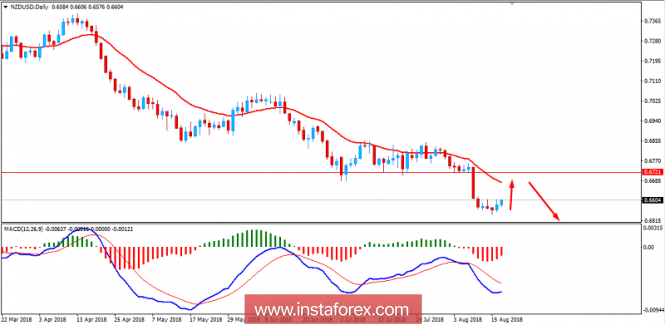

Now let us look at the technical view. The price is currently quite impulsive with the bullish gains. The price is expected to retrace towards 0.6700-20 area where the dynamic level of 20 EMA also rests. If the price manages to push higher towards the area, because of bearish confluence the price is expected to follow the trend and push lower towards 0.6500 area in the coming days. As the price remains below 0.68 with a daily close, the bearish bias is expected to continue.

SUPPORT: 0.6500

RESISTANCE: 0.6700-20, 0.68

BIAS: BEARISH

MOMENTUM: NON-VOLATILE