NZD/JPY has been quite impressive with the recent bullish momentum which led the price to retrace the 74.00 area before pushing a bit lower yesterday. JPY has been the dominant currency in the pair, but recently, NZD gained momentum with better economic reports where JPY struggled with the fundamentals.

This week, NZD Retail Sales report has been published with an increase to 1.1% from the previous value of 0.3% which was expected to be at 0.4% and Core Retail Sales report has been also published with an increase to 1.4% from the previous value of 0.6% which was expected to be at 0.8%. Moreover, RBNZ has been quite optimistic with the upcoming development having no plan to increase their interest rate from 1.75% for the coming months. Today, NZD Trade Balance report has been published with an increase to -143M from the previous figure of -288M which was expected to decrease to -400M. The positive result did play its part already, but it was not as impulsive as it was expected to be after the significant increase.

On the JPY side, today, JPY National Core CPI report has been published unchanged at 0.8% which was expected to increase to 0.9% and SPPI has been also published unchanged at 1.1% which was expected to increase to 1.2%. The worse results did weaken the JPY gains in the process.

As of the current scenario, JPY is still struggling with the poor economic results, whereas NZD has been quite positive. Though JPY has been dominating NZD for a long period of time, but having better fundamentals in the coming days, may lead NZD to gain further momentum and result in a strong counter in the process or else JPY may take the lead again to continue pushing lower in the future.

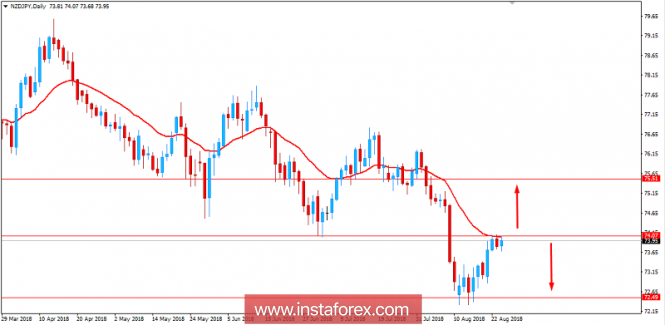

Now let us look at the technical view. The price is currently struggling at the edge of the 74.00 area, while dynamic level of 20 EMA is holding the price as resistance. Though the bullish momentum was quite corrective, whereas of the market context, the price has greater probability to push lower as of the existing trend, but a daily close above the 0.7400 area is expected to push the price higher towards the 75.50 area in the coming days. If the price manages to close below the 74.00 area with a daily close, the bearish bias is expected to continue and push the price lower towards the 72.50 area in the coming days.

SUPPORT: 72.50

RESISTANCE: 74.00, 75.50

BIAS; BEARISH

MOMENTUM: VOLATILE